by Fred Fuld III

The following informative interview was provided by Kenneth L. Fisher, founder and chairman of the money management firm Fisher Investments, who had the longest continuous running column in Forbes Magazine. He is a billionaire on the Forbes 400 list and author of numerous investment related books.

According to Investm ent Advisor magazine, he is one of the 30 most influential people in the investment advisory business over the last 30 years. Fisher is considered to be the largest wealth manager in the United States.

ent Advisor magazine, he is one of the 30 most influential people in the investment advisory business over the last 30 years. Fisher is considered to be the largest wealth manager in the United States.

We cover a lot in this interview, including:

- The stock market under President Donald Trump versus former Vice President Joe Biden

- The influence of corporate tax rate on the stocks

- The potential of the reversal of Trump’s tax bill on Day One if Joe Biden & Kamila Harris win the election

- The market under Republicans versus Democrats

- Whether inflation is on the horizon

- The petroleum industry

- Gross Output, GDP, and the economy versus the stock market

- Are stock ratios dead? (PE, PS, PEG)

- And much, much more

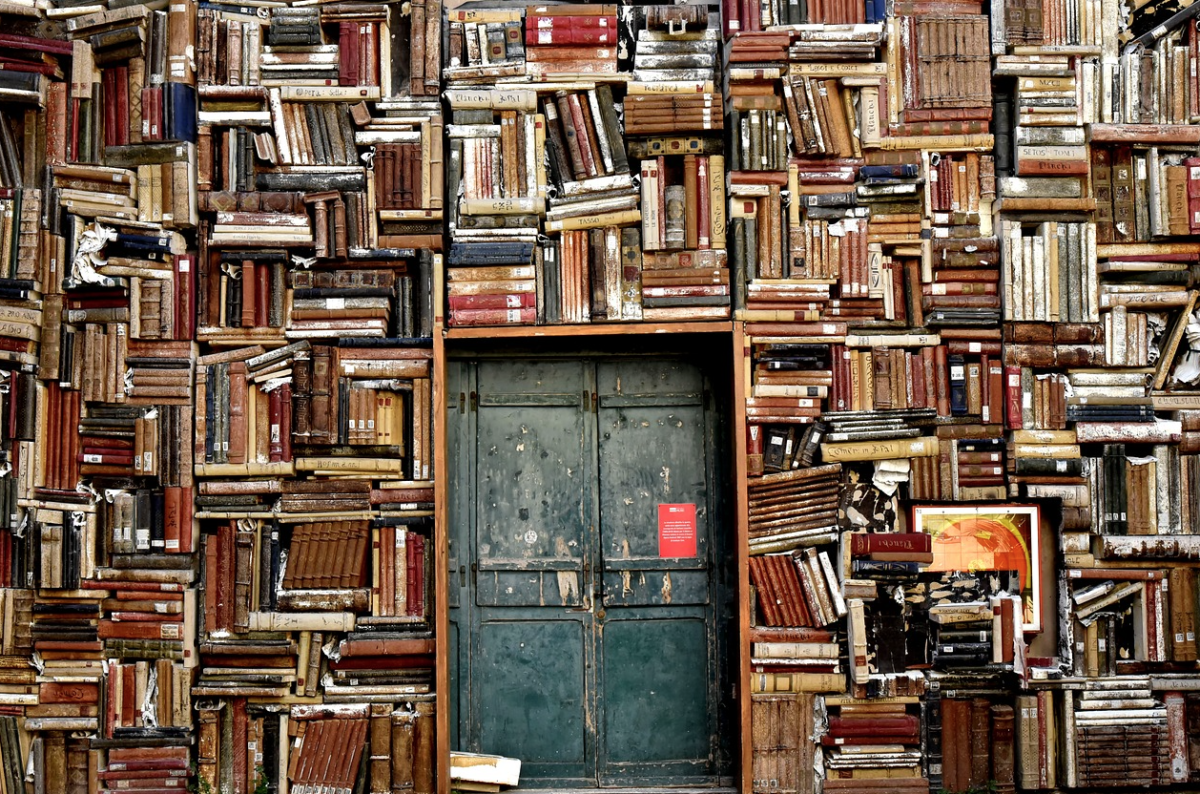

Two Timeless Books Mentioned by Ken Fisher in the Interview

The Only Three Questions That Still Count: Investing By Knowing What Others Don’t (A great companion to the Beat the Crowd: How You Can Out-Invest the Herd by Thinking Differently book, which I enjoyed reading.)

(My favorite of all his books is The Ten Roads to Riches: The Ways the Wealthy Got There (And How You Can Too!) Second Edition, because it is so different from all the other financial publications. It basically tells you ten ways, with all the steps, to get really rich, including “marrying a billionaire.” Lot’s of insight and lots of humor. You can find more info about this book on a previous podcast: Interview with Billionaire Ken Fisher about the 10 Roads to Riches.)

The Interview

Enjoy listening to the great insights and information that Ken Fisher provides.

To stream the interview, click:

HERE

You can also download the interview as an mp3 by right-clicking here and choosing “save as.”

Enjoy the interview and Happy Investing!

All opinions are those of Ken Fisher, and do not represent the opinions of this site or the interviewer. Neither this site, nor the interviewer, nor the interviewee are rendering tax, legal, or investment advice in this interview.

Don’t forget to subscribe to our newsletter:

As an Amazon Associate, earnings may be generated from qualifying purchases of books from affiliate links above.