by Fred Fuld III

If you are looking for a stock that has limited downside, it is hard to beat a stock that is trading at a price below the amount of cash it has per share, and on top of that, has little or no debt.

If a debt free company is selling below its cash per share, and if the company were to go out of business today, assuming all the company’s assets are completely worthless except for the cash, then an investor would have a guaranteed profit.

This biggest problem with these below-cash stocks is that sometimes corporate spending can deplete cash very quickly.

There are actually a few companies that all into this category, in spite of the fact that the stock market is trading near an all time high.

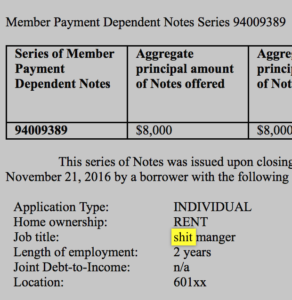

LendingClub Corp. (LC), which provides an online marketplace that facilitates loans to borrowers and investments, is trading at a 27$ discount to cash per share.

LendingClub is a financial services company headquartered in San Francisco, California. It was founded in 2007 and is the first peer-to-peer lender to register its offerings as securities with the Securities and Exchange Commission (SEC) and to offer loan trading on a secondary market.

Today, LendingClub is more than just a peer-to-peer lender. It is a full-spectrum fintech marketplace bank that offers a variety of financial products and services to its members, including:

- Personal loans: LendingClub offers personal loans for a variety of purposes, such as debt consolidation, home improvement, and medical expenses.

- Savings accounts: LendingClub offers high-yield savings accounts with competitive interest rates.

- Certificates of deposit (CDs): LendingClub offers CDs with a variety of terms and interest rates.

- Checking accounts: LendingClub offers checking accounts with features such as mobile banking and bill pay.

- Business loans: LendingClub offers small business loans for a variety of purposes, such as working capital, expansion, and equipment financing.

- Auto refinance loans: LendingClub offers auto refinance loans to help borrowers lower their interest rates and monthly payments.

- Patient solutions: LendingClub offers patient solutions to help borrowers with medical bills.

- K-12 education loans: LendingClub offers K-12 education loans to help parents finance their children’s education.

As of December 31, 2023, the company had over 4.7 million members and had originated over $80 billion in loans.

The stock is selling at a 24% discount to its book value, and has an excellent price to sales ratio of 0.75.

This $946 million market cap company has a trailing price to earnings ratio of 24 and a forward P/E of 10. Earnings per share growth next year is anticipated to be 270.66%.

American Well Corp. (AMWL), which provides online healthcare services, is trading at an amazing 24% discount to its cash per share, and the amount of long term debt being very low. The market capitalization is $316 million.

American Well Corp., operating as Amwell, is a leading company in the telemedicine field, headquartered in Boston, Massachusetts. They connect patients with doctors through secure video consultations, offering a convenient and flexible alternative to traditional in-person visits. Amwell primarily operates through two arms:

- Platform solutions: They provide a subscription-based platform to healthcare providers, enabling them to offer telehealth services to their patients. This includes features like scheduling, video conferencing, and electronic health record integration.

- Direct-to-consumer services: Through their Amwell Medical Group, patients can connect with licensed doctors directly for various non-emergency concerns,receiving diagnoses, prescriptions, and referrals if needed.

Amwell boasts a vast network, partnering with 55 health plans, 240 health systems, and over 40,000 providers, reaching millions of patients across the US. They also offer specialty consultations, chronic condition management programs, and are continuously expanding their services in this ever-evolving healthcare landscape.

The company has $538 million in cash, yet only $11.8 million in long term debt.

The stock has a reasonable price to sales ratio of 1.18 and an excellent price to book value of 0.63. Unfortunately, the company has been generating negative earnings.

NET Power, Inc. (NPWR), a $596 million market cap company, is a provider of clean energy technology.

Net Power Inc. is a clean energy technology company aiming to revolutionize power generation with their “energy trifecta”: clean, reliable, and low-cost energy. Founded in 2010 and headquartered in Durham, North Carolina, they focus on natural gas as a fuel source while capturing and sequestering the resulting CO2 emissions.

Their key innovation lies in the NET Power Cycle, an oxy-combustion process that combusts natural gas with pure oxygen. This unique method captures over 97% of carbon dioxide at the source, significantly reducing greenhouse gas emissions compared to traditional methods. Additionally, the captured CO2 can be used for industrial purposes or safely stored underground, further minimizing environmental impact.

The stock is trading at 92% of its cash per share and has no debt. Earnings have been negative.

Just Remember this About Below Cash Stocks

Often there are significant (negative) reasons why stocks sell below cash. In addition, these stocks are very low cap, so they should all be considered extremely speculative.

Disclosure: Author didn’t own any of the above at the time the article was written.