by Fred Fuld III

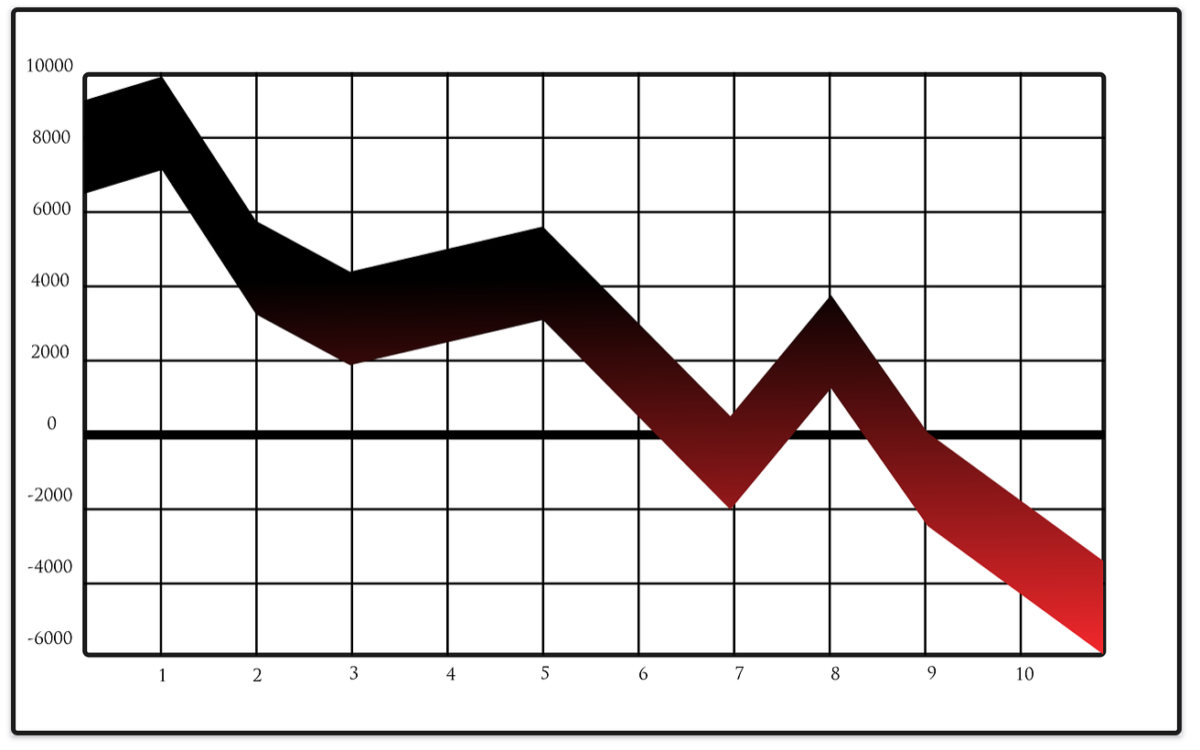

If you are wondering what a tax selling stock is, it is a stock that is currently selling for a low price but was trading at much higher levels earlier in the year.

As the year-end approaches, many investors employ the technique called tax harvesting , which is the selling of loser stocks to offset any gains that may have been established during the year.

With all the heavy selling, the price of the stocks that have had big drops tends to tank far more than what would normally take place during the rest of the year.

So traders and investors are on the lookout for tax selling bounce stocks that are heavily hit, hoping for a little (or big) bounce in January, once the tax selling is over.

Here are some stocks that are down over 50% year-to-date and have market caps in excess of $300 million. They are all based in the United States and have forward price to earnings ratios less than 50.

| Bit Digital, Inc. | BTBT |

| Chegg, Inc. | CHGG |

| CleanSpark, Inc. | CLSK |

| GrowGeneration Corp. | GRWG |

| WM Technology, Inc. | MAPS |

| PLAYSTUDIOS, Inc. | MYPS |

| Proto Labs, Inc. | PRLB |

| Sunlight Financial Holdings Inc. | SUNL |

Maybe someone’s tax losses can be your tax stock gains.

Disclosure: Author didn’t own any of the above at the time the article was written.