by Fred Fuld III

You may have read about all the hype over the last few months regarding non-fungible tokens, more commonly called NFTs, and occasionally referred to as nifties.

If you don’t know what an NFT is, I will try to explain it as simple as I can. An NFT is a digital asset, such as a jpg or png artwork, a gif, a cartoon, music, a video, digital sports cards, video game assets, and even naming rights to a giant sea bass. The NFT is recorded on a blockchain which secures the ownership of the asset and certifies that the asset is unique, or one of a very limited quantity.

Stock Ticker Man Spitting Out Money NFT

The NFTs are usually sold on platforms such as OpenSea, Rarible, SuperRare, and Foundation, with cryptocurrency, such as Ether, being the primary currency. Some sales have facilitators for buyers who just want to pay by credit card or check.

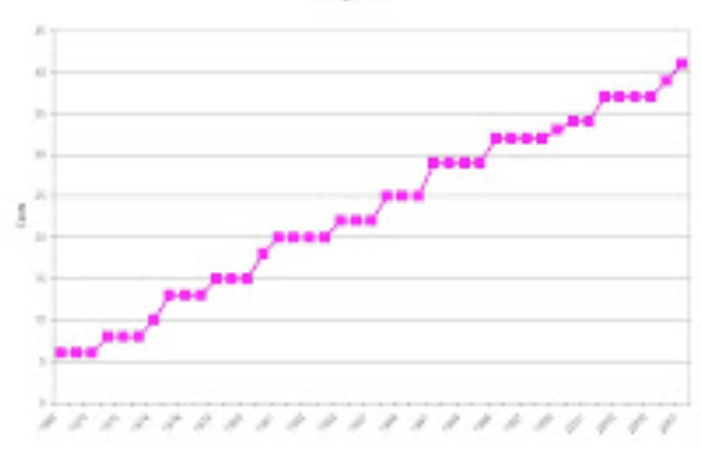

The prices of many of these NFTs has been skyrocketing. Last year, the NFT market was about $250 million. For the first quarter of this year, sales jumped to $2 billion. You may have heard that Jack Dorsey, the CEO of Twitter (TWTR), sold an NFT of his first tweet for $2.9 million.

Michelle Phillips, vocalist with the Mamas & the Papas, songwriter, and actress has gotten in on the act. A couple months ago, I interviewed her about her NFT auction (I believe it was her only NFT auction interview) and all ten of her NFTs sold out.

With regards to buying NFTs as an investment, I won’t comment on that because I never make investment recommendations. However, you should treat NFTs like art or collectables. If you like what you see and you plan to hold on to it without the expectation of reselling at a profit, then maybe you should buy it.

You might even want to create your own NFT. Click HERE for an example of a stock market themed NFT for sale on Rarible.