WTF Is Happening: Women Tech Founders on the Rise

By Nisa Amoils

YOUR NEXT BIG INVESTMENT IS WOMEN-LED TECH

While technological innovation is exploding and female pioneers are making remarkable strides across a wide range of emerging tech fields, inequity remains. However, the exciting new book by veteran tech investor, Nisa Amoils, provides a new appreciation of the extraordinary strides being made in disruptive technology by female entrepreneurs who are building a new world.

In WTF Is Happening: Women Tech Founders on the Rise, Amoils profiles thirteen female founders whose remarkable work today will make a profound difference in the way we all live tomorrow. You will find candid interviews with innovative female entrepreneurs in which they share their experiences in their own words. However, from robotics and virtual reality to drone technology and autonomous flight, these women are receiving only a small fraction of the available funding, an inequity that harms both innovators and investors alike.

WTF Is Happening offers powerful, evidence-based stories about young technologies and industries in their infancies led by women paving a path into our future—women who will very likely outperform for their investors. Further, WTF Is Happening also highlights statistics that prove that companies with at least one female founder did a better job creating value for investors.

“I wrote WTF Is Happening simply to shine a light on some amazing women tech founders. I want to raise awareness and to encourage others to follow in their footsteps, because you can’t be what you can’t see,” says Amoils. “The good news for investors and students of STEM alike is that there were so many candidates for inclusion that I had a hard time narrowing it down.”

So, whether you’re a VC searching for new cutting-edge technology, an investor looking for opportunities outside of their usual network or a young woman who’s considering entering the STEM fields, WTF Is Happening is your invitation to help shape the future.

This book is an invitation to young women who may not have thought about working in STEM fields, or starting their own tech companies. It’s an invitation to female entrepreneurs and investors to see themselves and their partners reflected in the stories. Most importantly, this book is an invitation to investors who are seeking exciting companies, calling upon them to see the amazing world female technologists are creating.

Aside from the well-published social benefits to society, there are investment opportunities with women-led companies which are often under-shopped and undervalued. Throughout her career as a tech investor, Amolis has watched female tech entrepreneurs struggle for VC funding as the money flows elsewhere. Readers will realize, investors who aren’t looking hard are leaving money on the table. In it you’ll also discover:

- The Gender Funding Discrepancy: why female entrepreneurs only received 2% of VC funding in 2018

- Tech predictions for the next five years

- Insider tips for stages of funding

- 12 reasons why women aren’t going anywhere in the future of tech

- Women Tech Founders offer the lessons they wish they knew to tomorrow’s STEM superstars

- 5 key lessons for the future women leaders of tech from today’s female founders and innovators

- The dynamic women making blockchain more accessible

- How investors are leaving money on the table

For the past decade Nisa Amoils has been a venture investor primarily focused on new technologies. She is a former securities lawyer and on the Boards of several companies and institutions including Wharton Entrepreneurship. She writes for Forbes and Blockchain Magazine and is a regular on CNBC, MSNBC, Fox, Cheddar and others. Prior to investing, she spent many years in business development at companies like Time Warner and NBC Universal and worked with many startups She holds a business degree from the University of Michigan and a law degree from the University of Pennsylvania.

The book, WTF Is Happening: Women Tech Founders on the Rise, is available on Amazon and other booksellers.

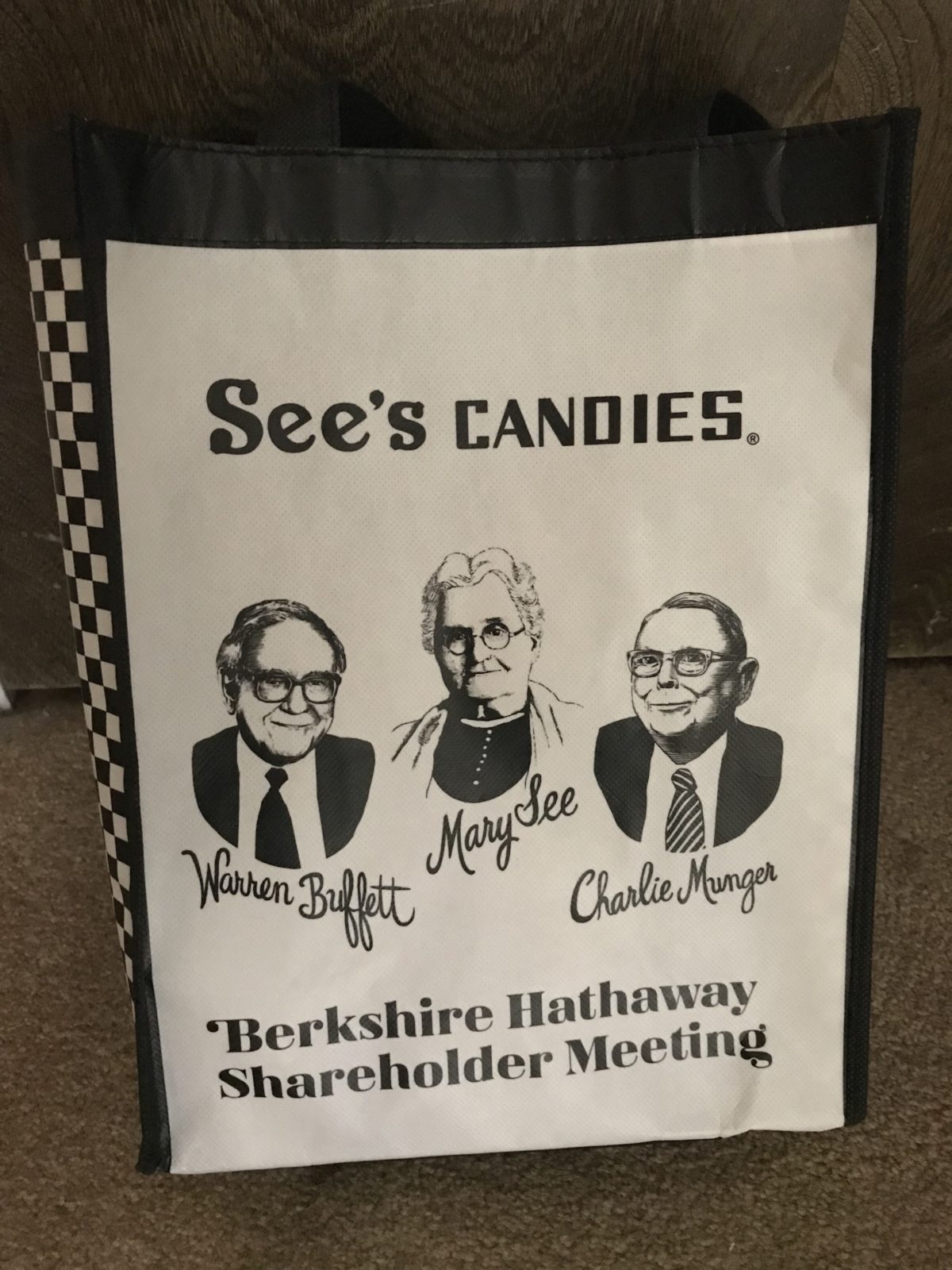

The event was held at the CHI Health Center Omaha Convention Center and Arena. The arena part of the center, which normally hosts basketball and hockey games, was where the meeting was held and the the convention center held the exhibiters of many of the companies that Berkshire Hathaway owns.

The event was held at the CHI Health Center Omaha Convention Center and Arena. The arena part of the center, which normally hosts basketball and hockey games, was where the meeting was held and the the convention center held the exhibiters of many of the companies that Berkshire Hathaway owns. Then on Saturday was the all-day annual meeting, starting with a movie about some of the products and services offered by Berkshire companies. After the movie was a question and answer session with Warren Buffett and Charlie Munger, which lasted all day long, other than a one hour lunch break. I don’t know how Warren and Charlie had the stamina. By two o’clock in the afternoon, I felt like taking a nap (but I didn’t).

Then on Saturday was the all-day annual meeting, starting with a movie about some of the products and services offered by Berkshire companies. After the movie was a question and answer session with Warren Buffett and Charlie Munger, which lasted all day long, other than a one hour lunch break. I don’t know how Warren and Charlie had the stamina. By two o’clock in the afternoon, I felt like taking a nap (but I didn’t).

Disclosure: Author owns BRKB.

Disclosure: Author owns BRKB.