by Fred Fuld III

Investors who are looking for income have several investment options, including money market funds, savings accounts, certificates of deposit, dividend-paying stocks, bonds, bond funds, bond ETFs, REITs, royalty trusts, and more.

However, I think that bond funds and bond ETFs are a terrible idea for long term income investors.

I think that all bond funds are terrible investments, even short term ones, and even government bond funds, especially during times of rising interest rates. The problem with bond funds is that there is no yield-to-maturity.

Remember, if you own a bond directly, and the bond drops in value, you will eventually get your money back at maturity.

When interest rates rise, bonds drop in value, and the net asset value drops. Many investors have a tendency to bail out when their investment drops, and when that happens, the fund managers need to sell bonds at a loss in order to handle redemptions, thereby locking in a loss on those bonds. The remaining bonds will eventually be paid off at maturity but that gain won’t cover the established losses.

Just one example of a short term government bond fund is the Vanguard Short-Term Treasury Fund Investor Shares (VFISX). The fund is down 5.4% during the last year, more than offsetting the yield on the fund, which is currently only 1.72%..

If yields drop or remain the same for a long period of time (I personally think that rates will continue higher), then in that case, the principal investment in the fund would be maintained.

However, if you know that interest rates are going to drop, then you should probably be doing some interest rate speculation.

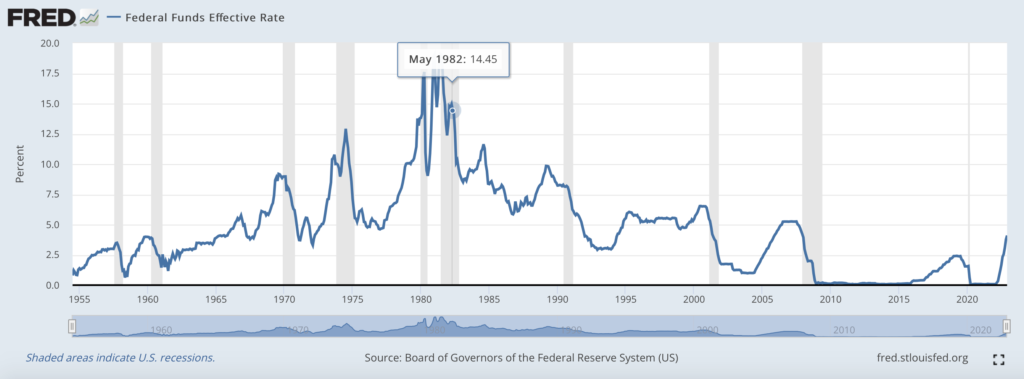

Does anyone really know what the Federal Reserve Board is going to do? Does the Fed even know what the Fed is going to do?

Interest rates have been very low for a long time, and we may see much higher rates in the future.

So what is an investor to do?

There are bond unit investment trusts, also called fixed income UITs, which contain a fixed portfolio of bonds. The trust pays out income monthly. As the bonds mature, the principal is paid back to the investors. Most brokerage firms offer these investment vehicles.

Another alternative is to buy bonds directly. This way, even if interest rates keep rising, the bond will eventually be paid off at par, generally $1000 per bond.

Here is one example. An AT&T 2.45% bond maturing on March 15, 2035 is selling at 84.36. This means that the bond is selling at 84.36% of face value, or for a $1000 bond, it would be selling for $843.60. This gives a rough yield to maturity of 4.13%.

So if interest rates rise, the bond may drop in value, but you will eventually receive $1000 per bond in a dozen years.

Another option includes Series I bonds; however, they don’t pay out interest.

Stocks that pay high dividends may be an alternative, but an investor should consider the market risk and fluctuation over the years.

Here are a few stocks with a strong rising dividend history:

| Symbol | Company | Yield |

| XOM | Exxon Mobil Corporation | 3.21% |

| JNJ | Johnson & Johnson | 2.69% |

| KO | The Coca-Cola Company | 2.93% |

| MCD | McDonald’s Corporation | 2.26% |

Maybe some of these ideas will help you increase your investment income.

Disclosure: Author owns KO and MCD.