by Fred Fuld III

A tax selling stock is a stock that is currently selling for a low price but was trading at much higher levels earlier in the same year, or even earlier years.

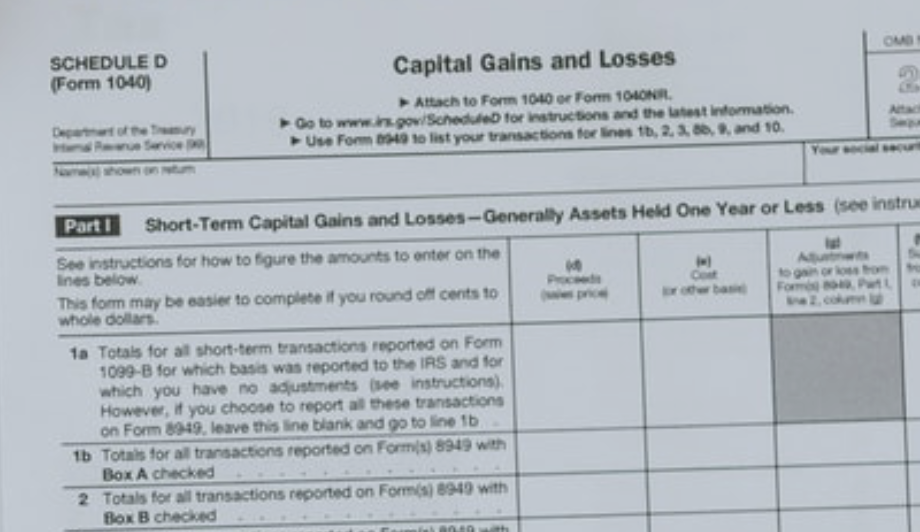

When the year end approaches, many investors utilize a strategy commonly referred to as tax harvesting , which is the selling of stocks at a loss to offset any gains that may have been made during the year.

Because of the heavy selling, the prices of stocks that have dropped substantially tend to sink far more than what would usually take place during the rest of the year. Then in January, with the strong selling over with, these stocks can recover somewhat.

So traders and investors are on the lookout for tax selling bounce stocks that are trading at much lower prices, hoping for a bounce in January, once the tax selling is over.

One type of stock that has been significantly hit were the SPACs, the special purpose acquisition companies that were so popular a few years ago.

These vehicles, also known as blank check companies, made it easy for private companies to go public. Some of the more well known SPACs include DraftKings (DKNG), down 49% year-to-date, and Virgin Galactic (SPCE), down 66%.

Unfortunately, the returns haven’t been so great, with many of them experiencing losses of over 90% from their highs.

Here are some additional SPACs that are down over 50% year-to-date. You will notice that several of them are electric vehicle companies.

| Company | Symbol | YTD Return |

| Arrival | ARVL | -96% |

| Shift Technologies | SFT | -93% |

| IronNet | IRNT | -92% |

| Ree Automotive | REE | -91% |

| Canoo | GOEV | -82% |

| BuzzFeed | BZFD | -80% |

| Lucid | LCID | -77% |

| AppHarvest | APPH | -77% |

| WeWork | WE | -75% |

| SoFi | SOFI | -73% |

| Lordstown Motors | RIDE | -59% |

| Fisker | FSR | -54% |

| Polestar | PSNY | -50% |

A couple things to remember. There is no guarantee that these stocks will bounce back in January, as there is usually a reason the stocks dropped so much in the first place.

Also, timing is everything with these tax-selling stocks. Sometimes the sellers are done selling in mid-December, sometimes they wait until year end.

Hope you get a bounce in your portfolio.

Disclosure: Author didn’t own any of the above at the time the article was written.