by Fred Fuld III

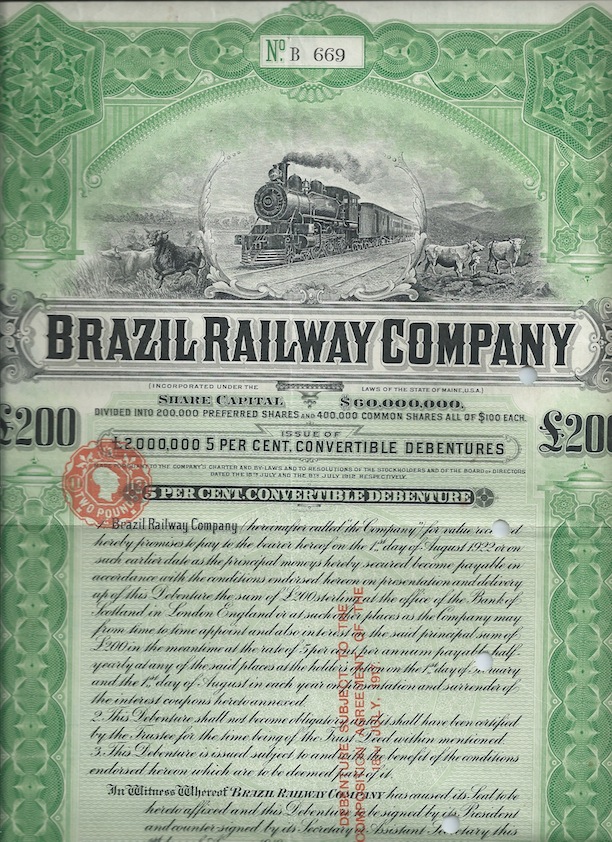

A convertible bond (often referred to as a convertible note or a convertible debenture) is a type of corporate bond that gives the bondholder the option to convert the bond into a predetermined number of the issuing company’s common stock or other securities, typically at a predetermined conversion price. In simpler terms, it is a bond that can be converted into shares of stock.

Do not confuse convertible bonds with convertible preferred stocks, which are a completely different type of security, and the subject of another article.

Here’s how a convertible bond works:

- Issuance: The company issues the convertible bond to investors, typically at a fixed interest rate and with a maturity date.

- Bondholder receives interest payments: Similar to regular bonds, the bondholder receives periodic interest payments (coupon payments) based on the bond’s face value and the fixed interest rate.

- Conversion option: The bondholder has the right, but not the obligation, to convert the bond into a specified number of shares of the issuing company’s stock. The conversion price is the predetermined price at which the bond can be converted into stock.

- Stock price appreciation: If the company’s stock price rises above the conversion price, the bondholder can convert the bond into stock and potentially benefit from the stock’s price appreciation.

Advantages of convertible bonds:

- Potential for capital appreciation: Convertible bonds offer the potential for investors to benefit from an increase in the issuing company’s stock price. If the stock price rises significantly, the bondholder can convert the bond and profit from the capital appreciation.

- Income generation: Before conversion, the bondholder receives regular interest payments, providing a steady income stream.

- Reduced downside risk: Unlike pure equity investments, convertible bondholders have a bond floor or a minimum value. If the company’s stock price declines, the bond retains some value as a fixed-income instrument.

- Priority: If the company goes out of business, the bondholders get paid off before the stockholders.

Disadvantages of convertible bonds:

- Lower coupon rates: Convertible bonds typically have lower coupon rates compared to regular bonds due to the additional value derived from the conversion feature. This means the bondholder may receive lower interest income compared to non-convertible bonds with similar risk profiles.

- Dilution risk: When bondholders convert their bonds into equity, new shares are issued, which can dilute the ownership stakes of existing shareholders.

- Limited potential upside: While convertible bondholders can benefit from stock price appreciation, the conversion feature may limit their potential gains compared to holding the company’s stock outright.

- Interest rate sensitivity: Convertible bond prices can be sensitive to changes in interest rates. If interest rates rise, the value of the bond may decline, affecting its attractiveness to investors.

- Liquidity: They can be illiquid, with most not traded on any exchange. Not all brokers offer them.

It’s important to note that the specific terms and features of convertible bonds can vary, so investors should carefully review the bond’s prospectus.

Tesla (TSLA) issued 2.00% Convertible Senior Notes due May 15, 2024. The bonds, which were issued in 2019, had an Initial Conversion Price of approximately $309.83 per share of Common Stock and an Initial Conversion Rate of 3.2276 shares of Common Stock per $1,000 principal amount of Notes.

Since that time, Tesla had a three for one stock split in 2022, so based on the prospectus, it appears that the conversion rate would be adjusted.

It is very difficult to find these bonds or even get a price.

The utility Southern Company (SO) issued its Series 2023A 3.875% Convertible Senior Notes due December 15, 2025.

Interest on the Convertible Notes will be paid semiannually at a rate of 3.875% per annum. The Convertible Notes will have an initial conversion rate of 11.8818 shares of Southern Company’s common stock per $1,000 principal amount of the Convertible Notes

PPL Capital Funding, Inc., a wholly-owned subsidiary of PPL Corporation (PPL), issued 2.875% Exchangeable Senior Notes due 2028.

The notes will be senior, unsecured obligations of PPL Capital Funding and will be fully and unconditionally guaranteed on a senior, unsecured basis by PPL Corporation. The notes will bear interest at a rate of 2.875% per year, payable semi-annually in arrears on March 15 and September 15 of each year, beginning on September 15, 2023. The notes will mature on March 15, 2028, unless earlier exchanged, redeemed or repurchased.

The notes will be exchangeable at an initial exchange rate of 29.3432 shares of PPL Corporation’s common stock per $1,000 principal amount of notes.

General Motors (GM) issued a mini-convertible bond at $25 par value. The General Motors, 5.25% Series B Convertible Senior Debentures due 3/5/2032 have a conversion rate of 0.3852. It appears that the bonds were formally exchange listed but have since been delisted, and from what I can tell, it appears that the bond interest payments have been suspended.

If you are considering converting a portion of your portfolio to convertibles, beware of the risks, and lack of liquidity.