by Fred Fuld III

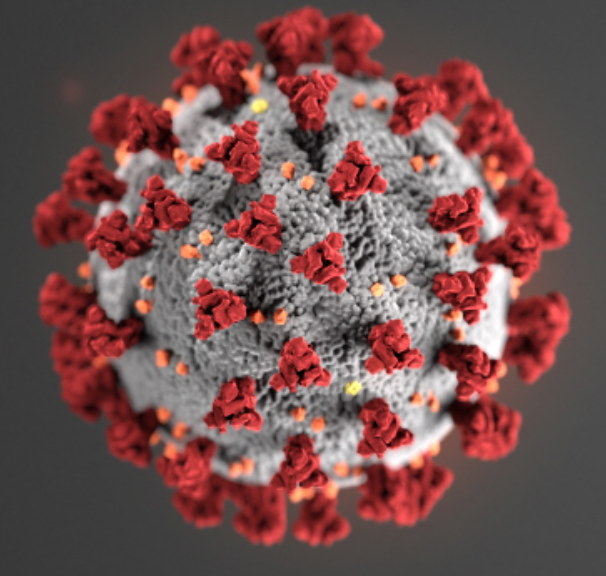

Based on data as of April 28 from the CDC, over 142 million Americans have received one dose of the COVID-19 vaccine and more than 90 million have been fully vaccinated. This amounts to about 68% of those over 65, 38% of those over 18, and approximately 30% of the U. S. population.

The big players in the coronavirus vaccine arena are Pfizer (PFE) which is in partnership with BioNTech (BNTX), Moderna (MRNA), Johnson & Johnson (JNJ), and AstraZeneca (AZN). Of course, there are a lot of smaller biotech companies involved in COVID-19 testing, treatment, and cures.

The first vaccine, a two-dose variety, was created by the Pfizer and BioNTech joint venture. Pfizer, with a market cap of $215 billion,trades at 22.6 times trailing earnings and 12 times forward earnings. It pays a generous yield of 4.04%. The company raised its dividend by 2.6% in January of this year, and has raised its dividend every year for over ten years.

BioNTech is a German based biotechnology company with a market cap of $46 billion. Trailing earnings have been negative, but the forward price to earnings ratio is 19.7. The stock does not pay a dividend.

Moderna was close on their heels with its own two-dose vaccine. This $70 billion company has a forward P/E ratio of 8.7 and has no dividends.

Johnson & Johnson subsequently released a one-dose vaccine, however, health issues were raised about the vaccine relating to blood clots affecting a very small number of people, plus there was a contamination issue relating to blood clots. J&J trades at 29 times trailing earnings and 17 times forward earnings. The dividend yield is a healthy 2.62%. The company recently announced a 4.95% increase in the dividend payout beginning in June.

Finally, the British company AstraZeneca has a vaccine but it is not yet approved by the U.S. Food and Drug Administration. For far, its vaccine has brought in $275 million in sales. The company has a market cap of $135 billion, a trailing P/E ratio of 42 and a forward P/E ratio of 21. The forward annual dividend yield is 2.7%. The dividend is paid semi-annually.

Maybe one of these stocks can protect your portfolio.

Disclosure: Author owns PFE.