Lucy Scientific Acquires High Times Intellectual Property, Including Existing Licensing Agreements in All-Stock Transaction

The Transaction includes international and domestic rights of the brand High Times, Cannabis Cup, and 420.com brands, and its respective domain names

VANCOUVER, British Columbia, September 7, 2023 – Lucy Scientific Discovery Inc. (“Lucy” or “the Company”) (NASDAQ: LSDI), a leading psychotropic innovator announces the acquisition of the intellectual property (IP) of High Times, the most recognizable and iconic brand in the cannabis industry. This acquisition provides a stream of high-margin licensing and royalty income from the well-regarded High Times, Cannabis Cup, and 420.com brands, including their respective domain names.

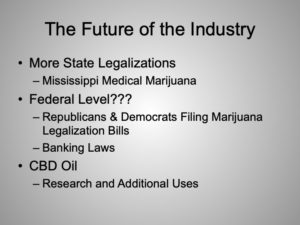

Lucy will issue 19.9% of its outstanding stock to High Times and make payments semi-annually for the next 5 years based on EBITDA generated from the acquired IP, which can be settled with either stock or cash at Lucy’s option. Additionally, Lucy will license the right to operate retail stores and manufacture and sell THC products in the United States back to High Times, in return for a license fee of $1.0M per year, increasing to $2.0M per year upon Federal legalization. The transaction is subject to customary closing conditions and is expected to close within two weeks.

Lucy will be acquiring brand rights with plans to monetize the IP through current and planned royalty agreements by further extending and enhancing the existing domestic and international licensing arrangements currently held by High Times, including consumer products and merchandise. The Company intends to preserve the essence of the High Times, Cannabis Cup, and 420.com brands while identifying new avenues for growth and development.

The Company expects the acquisition of High Times IP, including, the 18 licensing agreements across various product categories it will acquire, to add at least $10M of revenue and $5M of EBITDA to its 2024 results and provide a solid foundation of growth as cannabis becomes legal around the world.

Richard Nanula, CEO and Executive Chairman at Lucy Scientific Discovery Inc., commented, “Lucy expects this acquisition to drive high margin revenue quickly and sustainably across the cannabis sector around the world. This is a great opportunity to grow the market presence of the nearly 50 year old High Times brand globally through licensing and online distribution. We are confident that this opportunity can add significant value for our shareholders.”

Adam Levin, Executive Chairman of High Times added, “Over the past few years, we have been building the consumer products offerings for High Times and there is no better partner than Lucy to drive our iconic brand forward. This transaction will open up tremendous new opportunities to grow and expand the High Times brand led by Richard Nanula, who has decades of experience with some of the biggest consumer brands and companies in the world. We are delighted to become large Lucy shareholders.”

About Lucy Scientific Discovery Inc.

Lucy Scientific Discovery Inc. (NASDAQ: LSDI) is a Nasdaq-listed company with holdings and operations in a variety of psychotropic businesses. The company holds a Controlled Drugs and Substances Dealer’s License granted by Health Canada’s Office of Controlled Substances. Lucy Scientific Discovery Inc. and its wholly-owned subsidiary, LSDI Manufacturing Inc., operate under Part J of the Food and Drug Regulations promulgated under the Food and Drugs Act (Canada). This specialized license authorizes LSDI to develop, sell, deliver, and manufacture pharmaceutical-grade active pharmaceutical ingredients (APIs) used in controlled substances and their raw material precursors. With a focus on pioneering innovative therapies for patients in need, Lucy Scientific Discovery Inc. is dedicated to advancing the understanding and applications of psychotropic medicines, improving mental health outcomes, and enhancing well-being for individuals worldwide.

About High Times:

Since its founding 46 years ago, High Times has grown to be one of the world’s most well-known cannabis brands – championing the lifestyle and educating the masses on the benefits of this natural flower. From humble beginnings as a counterculture lifestyle publication, High Times has evolved into growing a network of cannabis dispensaries, the host and creator of events like the Cannabis Cup, the producer of globally distributed merchandise, participant in international licensing deals, and provider of content for a multitude of fans and supporters. In 2020, High Times began acquiring retail dispensaries, for the first time directly touching the plant it had been promoting for over 40 years. Today the brand owns 8 retail stores, as well as several cannabis brands.