by Fred Fuld III

Yes, you read that heading correctly. You can own penny stocks that don’t pay dividends or even regular stocks that don’t pay dividends, and still get income from them.

And for stocks that do pay dividends, you can increase your income from them.

I’m not talking about writing options. I’m not talking about selling off some of your shares.

What I am talking about is something called the Fully Paid Lending Income program which most major brokerage firms offer. It is a way of making money off traders who sold shares of a stock short .

Fully Paid Lending Income (FPLI) is a type of income that investors can earn by lending their fully paid securities to other market participants, such as hedge funds or other traders, who want to short sell the securities.

When investors lend their fully paid securities, they earn interest on the loan, which is referred to as FPLI. The interest rate is determined by market forces and may vary based on factors such as the demand for the security, the supply of available securities to lend, and the length of the loan period.

The process of FPLI works as follows: An investor with fully paid securities can lend them to a borrower through a lending agent, such as a broker-dealer or a custodian bank. The borrower then sells the securities on the market with the hope of buying them back later at a lower price. If successful, the borrower returns the securities to the lender, who earns interest on the loan.In summary, FPLI is a way for investors to earn additional income on their fully paid securities by lending them to other market participants who want to short sell the securities.

So you are probably wondering, can you really make any money from Fully Paid Lending? The answer is yes, and I’m talking from personal experience.

I recently called my broker about another issue relating to dividends, and as we were going through the income on my account, I noticed income of $164 listed as Miscellaneous. I asked the customer rep what that was and he told me that’s the fully paid lending income.

So I started to look back at previous months.

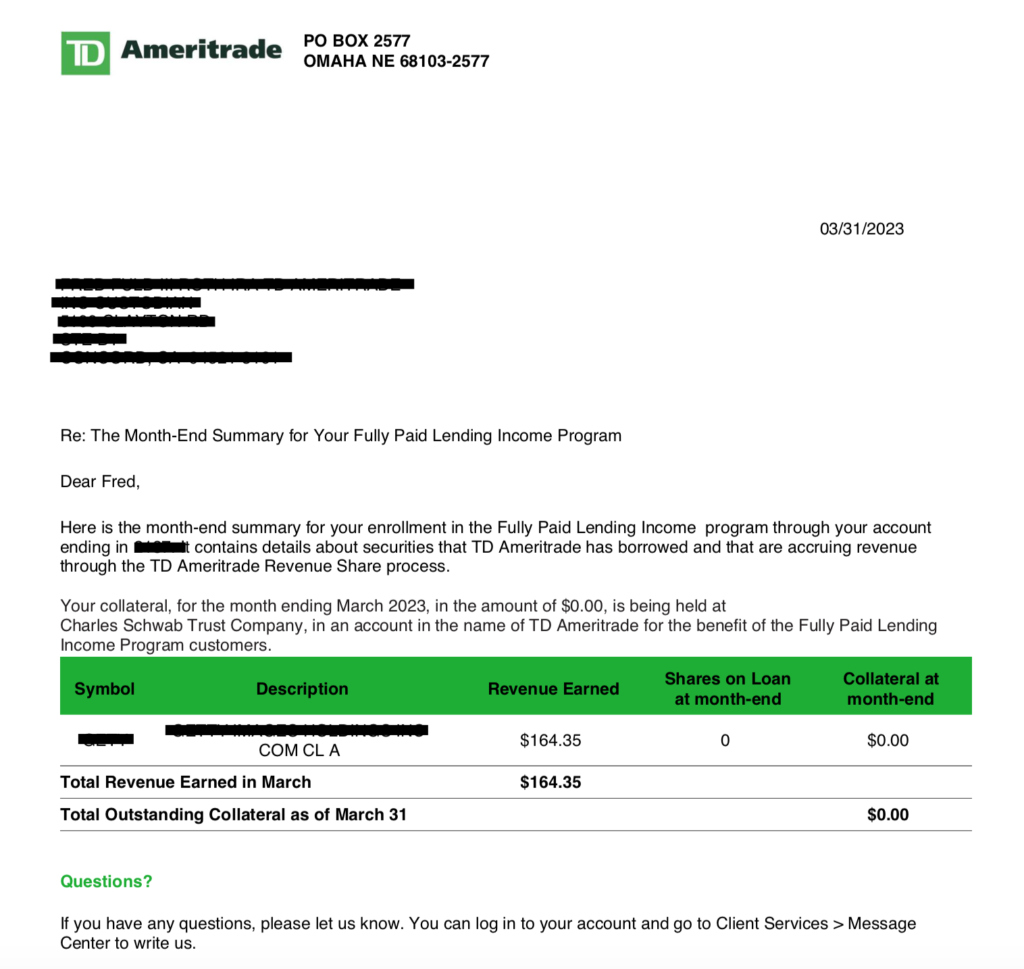

The following is an example from last month from my Roth IRA at TD Ameritrade. (Confidential information has been redacted.)

The dollar value of this stock during this time was around $8,000 and you will notice that the collateral at month-end was zero, which means that my shares were not borrowed for the entire month.

In spite of that, my stock generated over $164 for the month. That works out to 2% for just one month. Not too shabby for a stock that sells for around $4 and doesn’t pay a dividend. And if you annualize it…..

Now you are probably wondering, is this a one shot deal that you might get for only one month out of the year? The answer is no. Since December of last year, I have received over $100 every month.

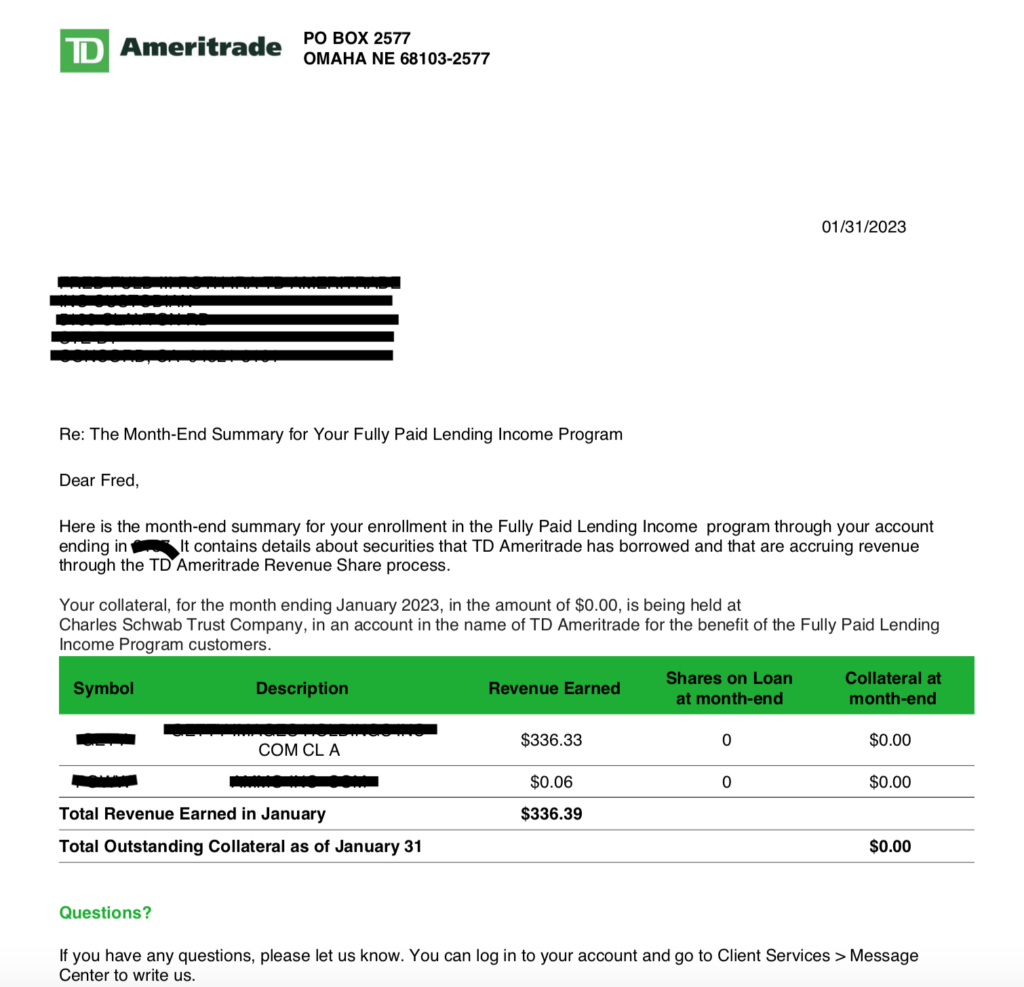

Here is another example from January.

You can see that the same stock that generated $164 last month brought me $336 in January.

Let’s assume conservatively that this stock generates $150 per month. That’s $1800 per year, and for $8000 worth of stock, that’s a 22.5% return!

Considering that I originally bought the stock for just capital gains, this additional income is a nice bonus.

Now for the downside. You will notice that I had a second stock in January, which only generated six cents in lending fees. That can happen.

Sometimes you don’t make much and sometimes you don’t make anything on your stockholdings, but when you do, the income can be fairly high depending on if the stock is hard to borrow.

Be aware that you are not automatically enrolled in this program. You need to contact your broker, fill out some forms (which might need to be physical forms instead of electronic), and then wait a couple days for it to be activated.

I could not find any disadvantage to the program, although there are some basic requirements. I can sell my stock at any time. You can enroll both a regular account and an IRA account.

The way I look at it, I have nothing to lose and the possibility of a lot to gain. Especially with the low priced stocks.

Here’s to getting additional income on your stock portfolio.