by Fred Fuld III

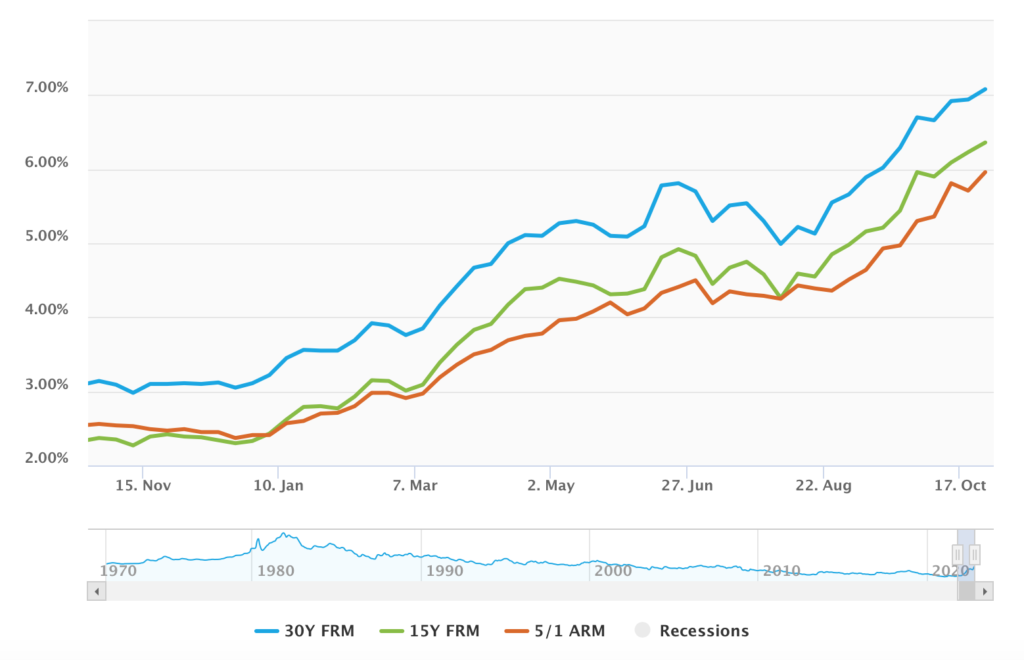

Just a year ago, 30-year fixed mortgages for homes were less than 3%, according to Fannie Mae. Now, the average mortgage rate is in excess of 7% for the same type of loan.

An increase like that, where the annual cost to own has more than doubled, has to affect the price of real estate.

New buyers of homes will be affected.

Existing homeowners with variable rates will be affected.

Potential buyers of commercial properties will also be affected.

When the cost to own goes up, the price of the asset has to drop in value, assuming all other details remain equal.

So suppose you want to make money from the drop in real estate but you don’t want to (or unable to) short stocks or ETFs.

What’s a trader or investor to do?

There are a few Inverse Real Estate Exchange Traded Funds, which increase as the stocks in the portfolio drop in value.

The ProShares Short Real Estate ETF (REK) has net assets of $72.8 million and has an expense ratio of 0.95%. It is up 30.2% so far this year.

If you want to get a bigger bang for your buck, there is the ProShares UltraShort Real Estate ETF (SRS), which has a goal, in very simple terms, of providing twice the inverse return of a portfolio of REITs and real estate stocks. It has $85.2 million in net assets with a 0.95% expense ratio. This ETF is up 61.5% so far this year.

The Direxion Daily Real Estate Bear 3X Shares (DRV) is what is referred to as a triple bearish ETF, the most volatile and speculative. It has $197.85 million in assets, a 0.99% expense ratio, and has a year-to-date return of 88.5%.

Hopefully you can find some way to make money from the real estate market, and congratulations to those with fixed mortgages below 4%.

Disclosure: Author didn’t own any of the above at the time the article was written.