If you are not aware of what precision medicine is, you should probably learn about it. Much information on precision medicine can be found on the site of the U. S. Government’s National Institute of Health National Library of Medicine.

According to the Precision Medicine Initiative, precision medicine is “an emerging approach for disease treatment and prevention that takes into account individual variability in genes, environment, and lifestyle for each person.” This approach will allow doctors and researchers to predict more accurately which treatment and prevention strategies for a particular disease will work in which groups of people. It is in contrast to a one-size-fits-all approach, in which disease treatment and prevention strategies are developed for the average person, with less consideration for the differences between individuals.

Although the term “precision medicine” is relatively new, the concept has been a part of healthcare for many years. For example, a person who needs a blood transfusion is not given blood from a randomly selected donor; instead, the donor’s blood type is matched to the recipient to reduce the risk of complications. Although examples can be found in several areas of medicine, the role of precision medicine in day-to-day healthcare is relatively limited. Researchers hope that this approach will expand to many areas of health and healthcare in coming years.

There is a lot of overlap between the terms “precision medicine” and “personalized medicine.” According to the National Research Council, “personalized medicine” is an older term with a meaning similar to “precision medicine.” However, there was concern that the word “personalized” could be misinterpreted to imply that treatments and preventions are being developed uniquely for each individual; in precision medicine, the focus is on identifying which approaches will be effective for which patients based on genetic, environmental, and lifestyle factors. The Council therefore preferred the term “precision medicine” to “personalized medicine.” However, some people still use the two terms interchangeably.

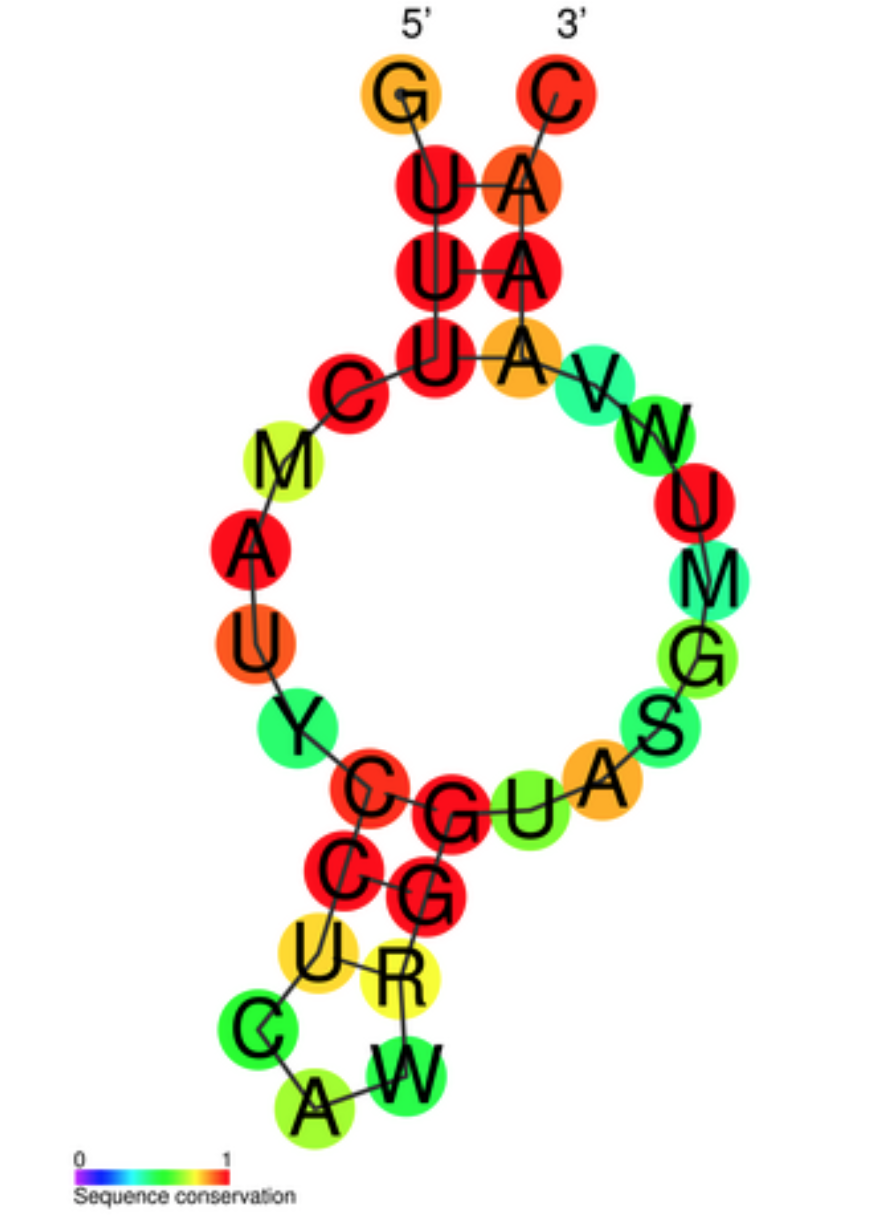

Pharmacogenomics is a part of precision medicine. Pharmacogenomics is the study of how genes affect a person’s response to particular drugs. This relatively new field combines pharmacology (the science of drugs) and genomics (the study of genes and their functions) to develop effective, safe medications and doses that are tailored to variations in a person’s genes.

Precision medicine holds promise for improving many aspects of health and healthcare. Some of these benefits will be apparent soon, as the All of Us Research Program continues and new tools and approaches for managing data are developed. Other benefits will result from long-term research in precision medicine and may not be realized for years.

Potential benefits of the Precision Medicine Initiative:

- New approaches for protecting research participants, particularly patients’ privacy and the confidentiality of their data.

- Design of new tools for building, analyzing, and sharing large sets of medical data.

- Improvement of FDA oversight of tests, drugs, and other technologies to support innovation while ensuring that these products are safe and effective.

- New partnerships of scientists in a wide range of specialties, as well as people from the patient advocacy community, universities, pharmaceutical companies, and others.

- Opportunity for a million people to contribute to the advancement of scientific research.

Potential long-term benefits of research in precision medicine:

- Wider ability of doctors to use patients’ genetic and other molecular information as part of routine medical care.

- Improved ability to predict which treatments will work best for specific patients.

- Better understanding of the underlying mechanisms by which various diseases occur.

- Improved approaches to preventing, diagnosing, and treating a wide range of diseases.

- Better integration of electronic health records (EHRs) in patient care, which will allow doctors and researchers to access medical data more easily.

For investors, there are a few stocks that participate in this industry.

Illumina (ILMN) makes and sells sequencing systems for for genomic analysis. The stock trades at 50 times trailing earnings and 46 times forward earnings. Earnings for the latest reported quarter were up 12%.

Vermillion (VRML) develops diagnostic tests, including genetics testing through its ASPiRA GenetiX platform for hereditary breast and ovarian cancer. The company is currently generating negative earnings.

Vertex Pharmaceuticals (VRTX) has developed gene therapy for treating cystic fibrosis. The stock has a price to earnings of 28 and a forward P/E ratio of 36.

Other companies involved in the precision medicine which are worth investigating are Biomarin Pharmaceutical (BMRN), IQVIA Holdings (IQV), and Loncar Cancer Immunotherapy ETF (CNCR).

Keep in mind that there are several industries that will be leaders in the future, and precision medicine will be one of them.

Disclosure: Author didn’t own any of the above at the time the article was written.