by Fred Fuld III

If you had invested in the stock market exactly ten years ago, you would have almost doubled your money. The SPDR® S&P 500 ETF has increased by 96% during that time period, and that includes a big drop that took place right at the beginning from June 2008 to March 2009.

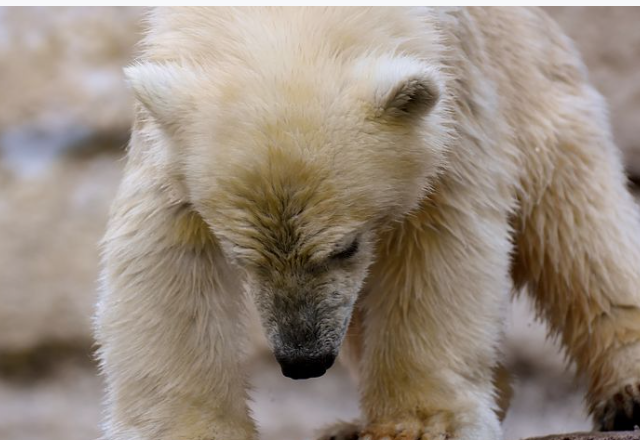

Many investors and traders think the market is a bit toppy and are looking for ways to make money on the downside, in case we enter a bear market.

There are many ways to profit from a stock market drop without having to incur the unlimited risk or shorting stocks, and without having to buy puts with their own set of limitations.

One way to aggressively play the short side of the stock market is to buy the triple leveraged bearish exchange traded funds. These ETFs provide triple the inverse return of indices. They are available for general market indices, specific industries, and countries.

There are over two dozen triple leveraged bearish ETFs. They have significant volatility, and may have wide bid and asked spreads, and low volume. Plus, the losses can be quick and substantial. They ETFs are designed for short term trading, not long term holds.

Of course, the advantage of these trading vehicles is that they are a way of shorting various indexes without actually shorting an ETF, plus there is a limit on the downside.

One of the more actively traded triple bearish ETFs is the ProShares UltraPro Short Dow30 (SDOW). The average daily volume is 1.3 million shares.

In terms of industries, you have available the 3X bear ETFs. A couple of example are the Direxion Daily Semiconductor Bear 3X ETF (SOXS) and the Direxion Daily Energy Bear 3X ETF (ERY).

To access a free list of over two dozen of these investments, go to the triple leveraged bearish ETFs.