by Fred Fuld III

Taylor Swift, the name synonymous with chart-topping hits and captivating performances, has also quietly built herself into a savvy business mogul. Her journey extends far beyond the recording studio, encompassing strategic branding, fan engagement mastery, and a fierce fight for artistic ownership.

Taylor Swift’s success goes beyond just being a talented musician. Here are some of her notable business decisions that have contributed to her empire:

1. Reclaiming her music: Swift’s decision to re-record her first six albums was a bold move. While motivated by a desire to own her masters, it also proved to be a successful business strategy. The re-recordings, titled “Taylor’s Versions,” topped charts and reminded fans of her music, leading to increased sales and streaming.

2. Strategic partnerships: Swift has partnered with various brands like Diet Coke and Apple Music, creating mutually beneficial campaigns. These partnerships not only generate revenue but also expand her reach and connect her with new audiences.

3. Building a strong brand: From her signature songwriting style to her nostalgic album themes, Swift has built a strong and consistent brand identity. This allows her to connect deeply with her fans (affectionately called “Swifties”) and fosters a sense of community around her music.

4. Mastering fan engagement: Swift’s social media presence and interaction with fans are legendary. Through online interactions, surprise appearances, and Easter eggs in her music and videos, she fosters a loyal and engaged fanbase, which translates into success in ventures like tours and merchandise sales.

5. Utilizing technology: Swift’s embrace of technology has been crucial. She understands the evolving music landscape and leverages streaming platforms, online exclusives, and digital marketing strategies effectively.

6. Advocating for artists’ rights: Swift has been a vocal advocate for artists’ ownership of their work, influencing industry conversations and inspiring other musicians to fight for their rights. This not only benefits her personally but also contributes to a fairer music industry for all creators.

These are just a few examples of Taylor Swift’s successful business decisions. Her combination of artistic talent, business acumen, and dedication to her fans has made her a true force to be reckoned with in the music industry and beyond.

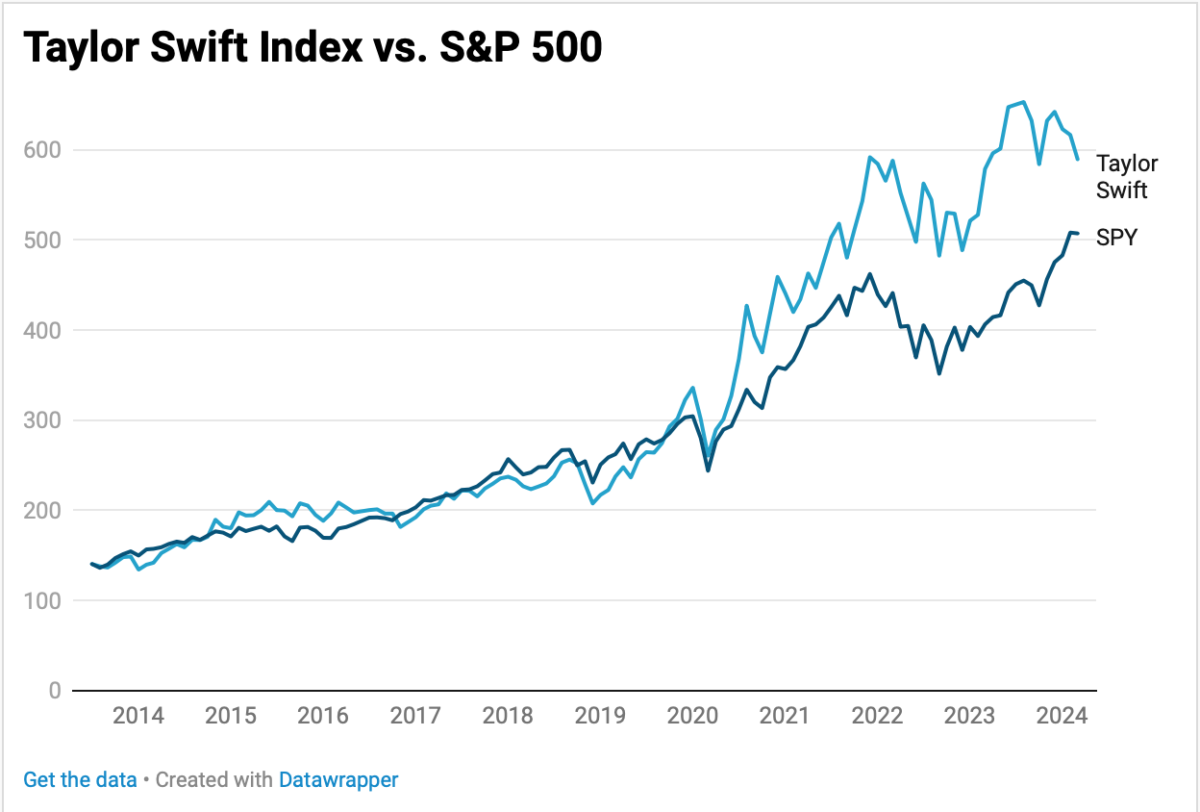

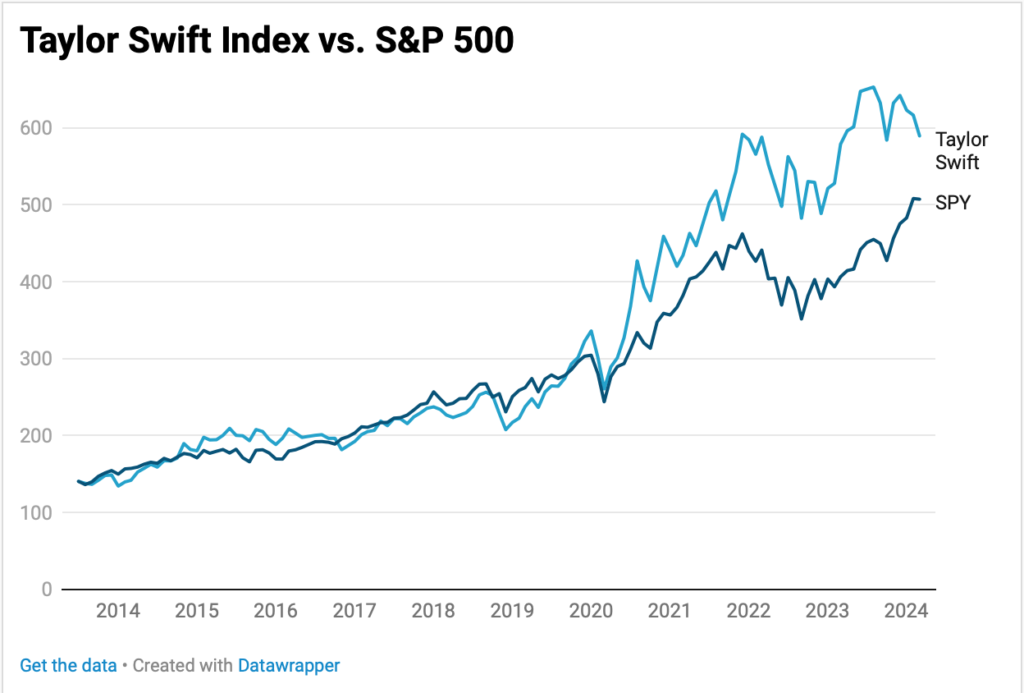

Six months ago, I wrote about how the Taylor Swift stock index as outperformed the S&P 500. Her index is made up of the publicly traded companies that Swift is a spokesperson for, such as Coca-Cola (KO) and Apple (AAPL).

Her index is up over 319% during the last ten years, versus 261% for the S&P 500, based on the SPDR S&P 500 ETF (SPY).

Swift’s boyfriend, Travis Kelce, has done a ton of celebrity sponsorships. It will be interesting to see how well his index does. Subscribe to our newsletter so you will be notified when it is available.

Disclosure: Author owns AAPL and has a short SPY position.