by Fred Fuld III

Do you know what the biggest mistake you can make as an investor? Selling too soon. Just because you have a great profit on a stock, doesn’t mean you should sell it, assuming you are a long term investor and not a trader.

I have many examples of selling too soon. Here are just a few.

When I was in the financial services industry many years ago, I was selling a lot of the Franklin Municipal Bond Funds and Franklin GNMA Funds to my clients.

I went to visit the Franklin Mutual Funds headquarters (the company was in its old building at the time, and is now called Franklin Templeton) to do some due diligence, and meet with the broker liaison at the company.

When I was given a tour of the place, I noticed that walls were being knocked down, four employees were sharing a small office designed for one person, and cables were literally being run down the hallways by installers right in front of me.

My first thought was “Wow, this company is growing like crazy. I should check and see if Franklin Resources (BEN) is publicly traded.” It was, on the Pink Sheets. (This was way before it was traded on the New York Stock Exchange.) I bought a couple hundred shares at about $7 per share, and it shortly rose to $8.

Also, at that time, I just bought a rental property. I thought at the time that I should probably sell the Franklin stock in case I needed the funds to do upgrades on the property, plus I had just made a 14% profit in a short period of time. I actually didn’t need the funds for the down payment since I bought the property for nothing down (that’s another story I will write about eventually).

Since then, the stock has had ten stock splits. If I had just kept the stock and forgot about it, my $1400 original investment would now be worth around $542,000.

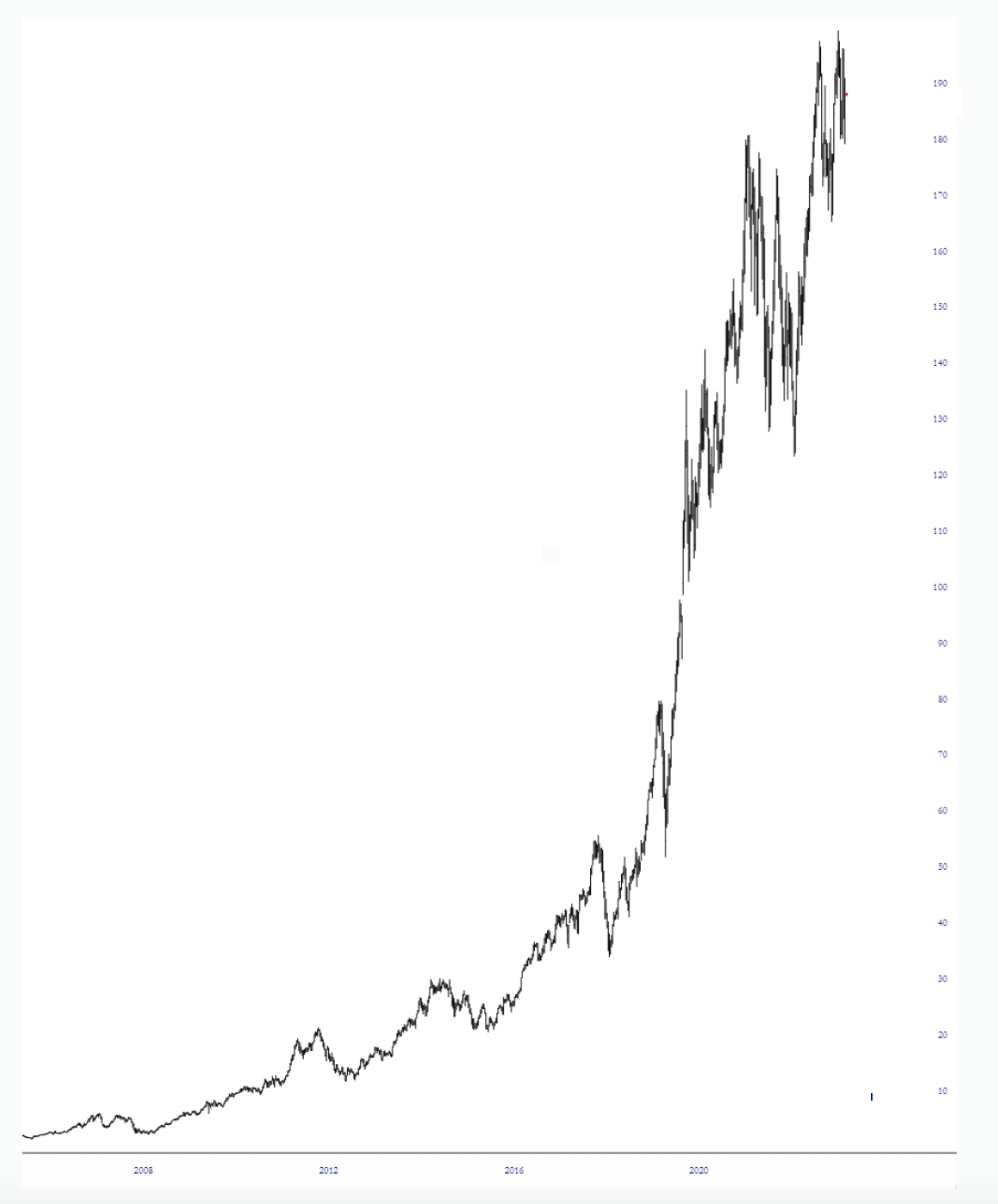

I have another example. I had 100 shares of Boston Beer Company (SAM) that I held in the form of multiple certificates on one share each (another story). I had paid about $30 a share for the stock back in 2009.

The next year, it rose to $90 a share. I thought that tripling my money in such a short period was a pretty good return, actually a fantastic return, so I thought, why not take all these certificates in to my broker and liquidate them.

While I was in the brokerage firm and one of the representatives was preparing a receipt for me including making copies of every certificate, another representative came over and said “What the hell is with all these certificates?”

When he was making these rude comments, I seriously considered picking up my certificates, and leaving, but I didn’t, unfortunately. I wanted to take my profit. The stocks eventually traded over $1000 a share back in 2020 and 2021. The stock is now trading over $350 a share, still more than ten times my cost.

I could tell you one more story about Apple (AAPL) stock, but it would make you sick. It makes me sick even to think about it.

The point that I’m making is that the dollar amount of profit and the percentage amount of profit you have in a stock is irrelevant. If you believe in the company, there is no reason to sell it, unless you are very desperate for money. And if you are that desperate, see if you can get by with selling half.

Obviously, there’s a chance of holding on to losers, and not getting out soon enough. Maybe you lose $5,000 or $10,000 on a stock that goes to zero. But it’s the big long term winners that pay for all those losses, and still provide huge returns.

The best way to tell if you should sell a stock is to imagine that you didn’t own the stock but you have the money to buy it. Would you buy it now? If the answer is yes, hold on to the stock. If the answer is no, then maybe it is time to sell.

Disclosure: Author owns AAPL and SAM.