by Fred Fuld III

FTX is a cryptocurrency exchange that just declared bankruptcy. It was founded in 2019 and based in the Bahamas. The company filed for bankruptcy today, November 11, 2022, due to a collapse in the price of the company’s exchange token FTT and a run on FTX.

How Did FTX Begin?

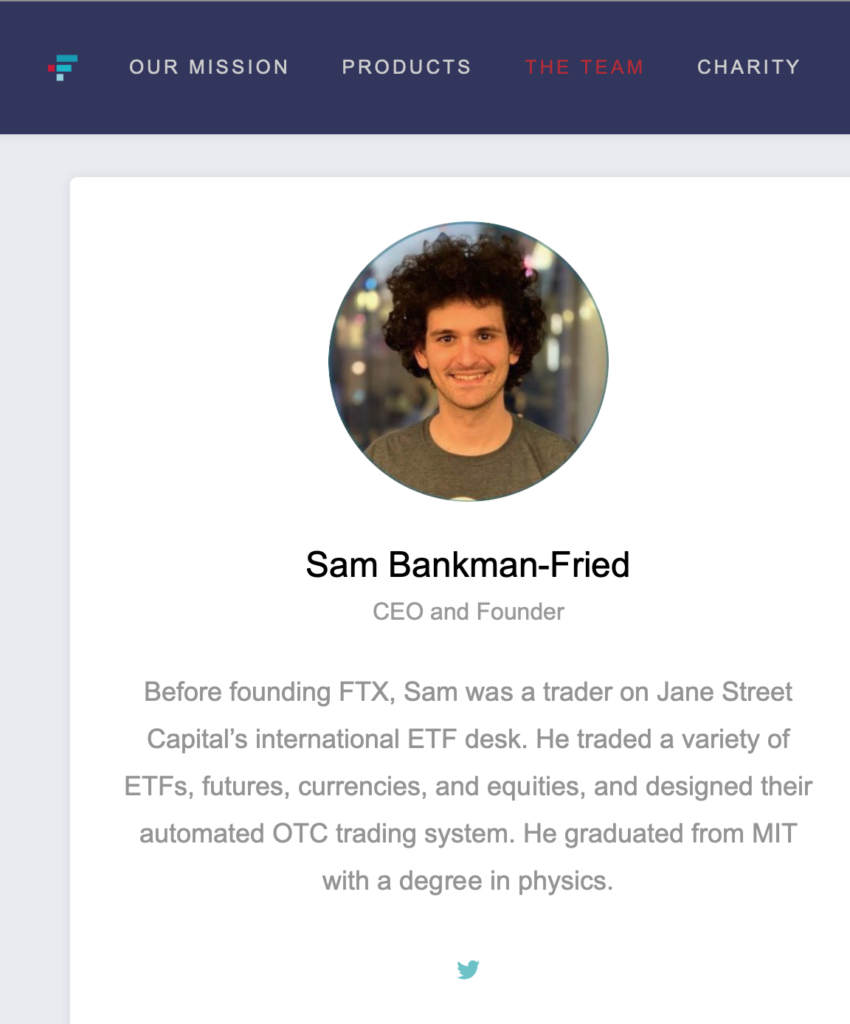

FTX was founded in 2019 by Sam Bankman-Fried and Gary Wang. Bankman-Fried started a quantitative trading firm Alameda Research. Bankman-Fried formerly worked as an ETF trader for the proprietary trading firm, Jane Street Capital.

FTX Investigations

In August 2022, the Federal Deposit Insurance Corporation (FDIC) issued a cease-and-desist letter to FTX accusing the company of making “false and misleading representations” about FDIC insurance due to a tweet by FTX president at the time, Brett Harrison. He later resigned on September 27, 2022

Two months later, Texas regulators investigated the company for allegedly selling unregistered securities.

FTX Collapse

CoinDesk published an article on November 2, 2022, describing how a large portion of Alameda Research’s assets were held in FTT.

On November 7, Binance CEO Changpeng Zhao posted on Twitter that his company planned to sell all its holdings of FTT.

This obviously impacted FTT’s price and affected the prices of other cryptocurrencies.

This led to a bank run lasting three days of approximately $6 billion.

The next day, Zhao announced Binance had agreed to a non-binding agreement to purchase FTX, but did not include the sale of FTX.US, a separate exchange for United States citizens.

On November 9, Binance decided that it would not go ahead with the deal to acquire FTX, due to FTX’s reported mishandling of customer funds and pending investigations.

On the same day, FTX’s website said that withdrawals would not be processed at that time

Bankman-Fried stated that FTX.US was “not currently impacted” by the crisis

Venture capital firms that had invested in the company include Tiger Global Management and SoftBank Group.

According to a November 10 article in the Wall Street Journal, Alameda Research owed FTX some $10 billion, as FTX had lent out funds on the exchange for trading to Alameda so that Alameda could make investments.

FTX, FTX US, and Alameda filed for bankruptcy in Delaware on November11, and Bankman-Fried resigned as CEO.

Sponsorships

FTX has the naming rights to the Miami Heat’s basketball stadium, renaming it FTX Arena, plus naming for other sporting events.

NFL star Tom Brady and NBA star Steph Curry were the company’s two main ambassadors.