by Fred Fuld III

Taylor Swift is not only beautiful and a great singer, songwriter, and actress, she is also very intelligent, especially in the area of finance.

Did you know that she almost became a celebrity spokesperson for FTX, the cryptocurrency company that was involved in a scandal that involved the arrest of the founder for fraud charges.

Taylor Swift was reportedly offered a $100 million sponsorship deal with the FTX cryptocurrency exchange. However, she ultimately declined the deal after asking FTX representatives a simple question: “Can you tell me that these are not unregistered securities?”

This question was significant because it raised the issue of whether FTX was selling unregistered securities. Unregistered securities are a type of investment that is not registered with the Securities and Exchange Commission. This means that investors in unregistered securities do not have the same level of protection as investors in registered securities.

Swift’s question about unregistered securities appears to have been a dealbreaker for FTX.

In addition to asking about unregistered securities, Swift reportedly also did her own research on FTX before deciding to decline the sponsorship deal. She reportedly read the company’s white paper and spoke to other celebrities who had been involved with FTX.

Unfortunately for those other celebrities, which included Tom Brady, Gisele Bündchen, Steph Curry, Naomi Osaka, David Ortiz, Shaquille O’Neal, Kevin O’Leary, and Larry David, they got caught up in the scandal.

These celebrities appeared in paid advertising campaigns for FTX and promoted the exchange on social media.

In December 2022, a class-action lawsuit was filed against FTX and its celebrity endorsers. The lawsuit alleges that the celebrities engaged in deceptive practices to sell FTX yield-bearing digital currency accounts.

Taylor Swift, as a prominent figure in the entertainment industry, has been sought after by various brands for celebrity endorsements. Three notable endorsements in her career include Coca-Cola’s (KO) Diet Coke, Apple (AAPL), and Coty (COTY).

Swift signed a multi-year partnership with Diet Coke in 2013. She became the face of their brand and appeared in commercials and print advertisements. The collaboration aimed to promote the brand’s message of positivity and refreshment. Swift’s bubbly personality and wide fan base made her an ideal ambassador for Diet Coke, and her endorsement helped raise brand awareness and reach a younger demographic.

In 2015, Swift teamed up with Apple for an exclusive endorsement deal. It started with a public disagreement when Swift criticized Apple Music’s initial policy of not compensating artists during the service’s three-month free trial period. After Apple changed its policy, Swift became an advocate for the platform and released her album “1989” exclusively on Apple Music. She also appeared in commercials and promotional materials for the streaming service, showcasing her influence in the music industry and helping Apple Music gain popularity among her dedicated fanbase.

Coty, a major beauty and fragrance company for the CoverGirl cosmetics brand, partnered with Taylor Swift in 2010 to launch to launch NatureLuxe makeup. The partnership with Coty allowed Swift to expand her brand beyond music into the lucrative world of celebrity fragrances.

These endorsements showcase Taylor Swift’s ability to align herself with influential brands and effectively promote their products. Her partnerships have not only enhanced her public image but have also allowed her to diversify her portfolio and extend her brand beyond the music industry.

I have developed stock indices for many celebrities, such as Gisele Bündchen, which I originally created back in 2007.

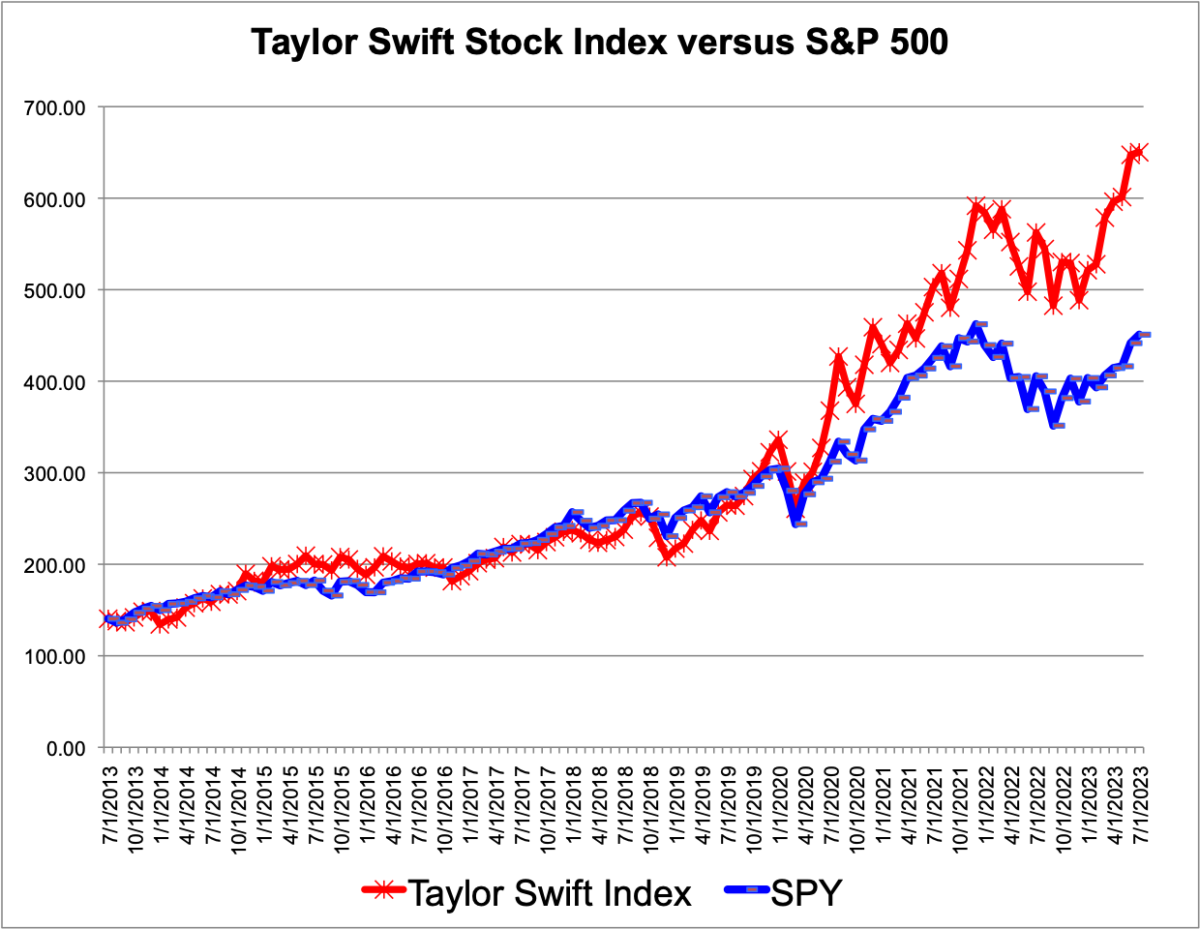

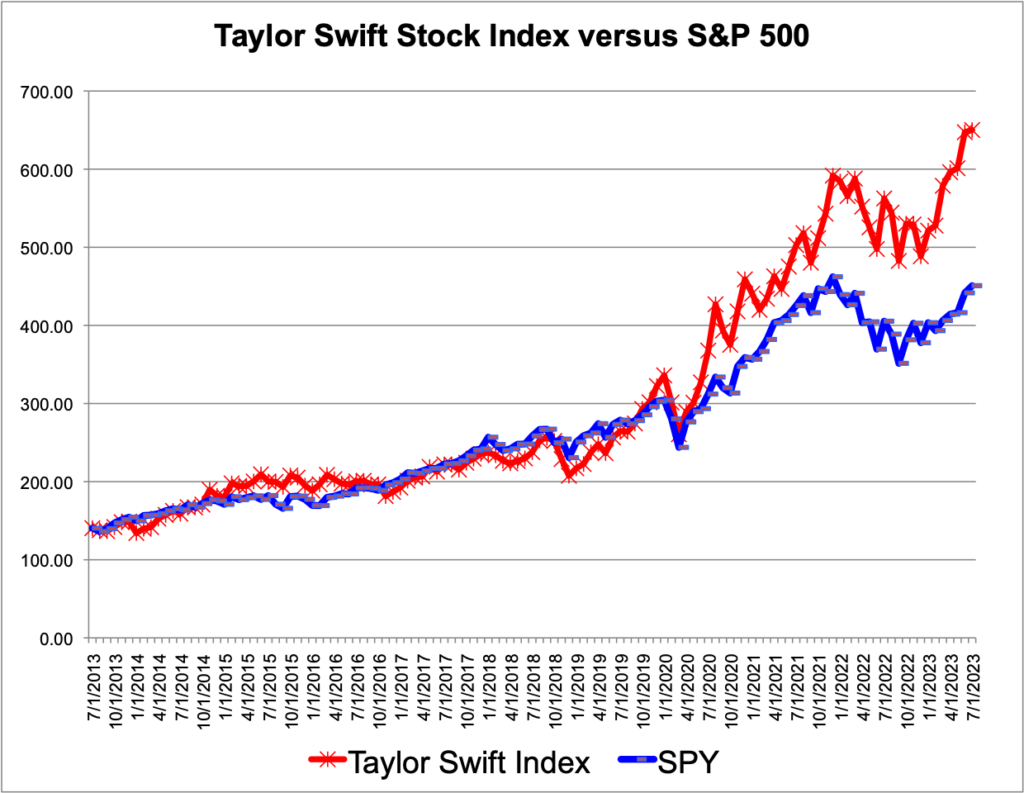

Because of Swift’s astute review of endorsements, I thought it would be interesting to see how the stocks of the major companies that she endorsed have done over time, compared to the S&P 500, as measured by the SPY ETF.

She was in the Got Milk? campaign, but obviously, the California Milk Processor Board is not a publicly traded stock. She also promoted L.E.I. Jeans, a brand owned by Nine West Holdings, a privately held company.

So I stuck with the three major companies that she was connected with, Coca-Cola, Apple, and Coty.

What are the results?

I ran the analysis over a ten year period, from July 1, 2013 to July of this year. Over that period of time, the Taylor Swift Stock Index outperformed the S&P 500 by a very substantial amount.

Taylor Swift was up 362.95% versus the SPY, which was up only 221.04%. Just look at the chart to see the difference.

Data Source: Yahoo! Finance: Historical Prices

Maybe one of these stocks is singing your song.

Prices are beginning of month first trading day close, adjusted for splits, dividends, and capital gains distributions. The Taylor Swift Index is a price-weighted index, similar to the Dow Jones Industrial Average.

Disclosure: Author owns AAPL.