by Fred Fuld III

Six months ago, I posted an article about the political ETFs, which track the investments of politicians based on the reporting of their transactions, which politicians are legally required to provide.

I mentioned in that article that year-to-date, Democrats were far outperforming the Republicans.

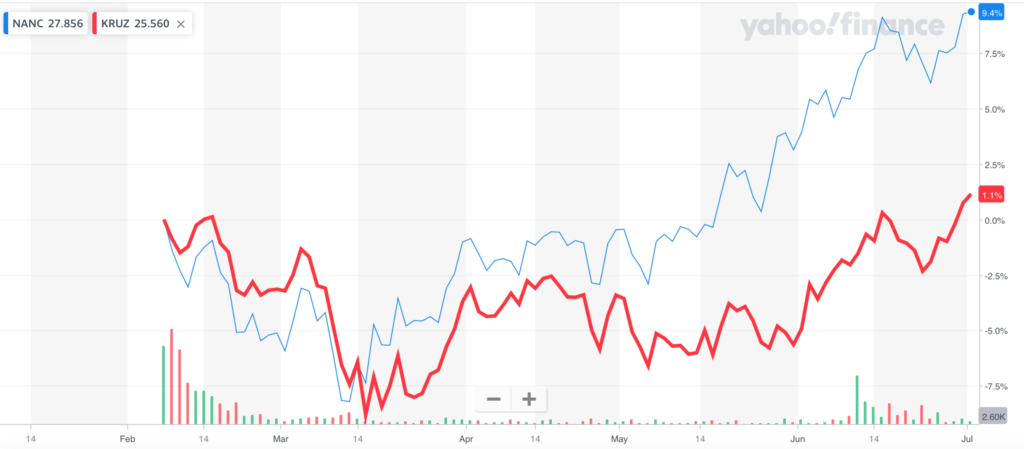

The Democrats, based on the return of the Unusual Whales Subversive Democratic Trading ETF (NANC), was up 9.4% with the Republicans, Unusual Whales Subversive Republican Trading ETF (KRUZ), trailing far behind at 1.1% for the first half of the year.

Now that the year is over, we can see that the Democratic politicians are still outperforming as investors.

Republicans were up only 9.05%, yet the return for Democrats had a return that was more than double that at 19.67%.

NANC blue line vs. KRUZ green line. Source: Yahoo!Finance

Then there is the Political Contribution Comparison. What it shows is the returns of companies that make political contributions to Democratic versus Republican candidates and political action committees.

This analysis shows even more dramatic returns.

The Democratic Large Cap Core ETF (DEMZ) invests in large cap companies that make political contributions to Democratic Party candidates and political action committees above a certain threshold. Total return for the year is 23.32%.

The Point Bridge America First ETF (MAGA) has a goal of investing in companies that are highly supportive of Republican candidates. The return for 2023 was just 8.63%.

DEMZ blue line vs. MAGA green line. Source: Yahoo!Finance

Finally, there are the semi-political ETFs. These ETFs are somewhat different in that they leave the politicians out of the analysis, both as investors and political donees. These ETFs have very different returns.

The God Bless America ETF (YALL) is an ETF that screens out companies that support liberal political activism and social agendas. It was up an incredible 36.7% for the year.

The American Conservative Values ETF (ACVF) invests in stocks that meet its politically conservative criteria. The annual return was a positive 23.1%.

Two other “conservative” politically oriented ETFs closed up shop back in August, primarily due to “limited asset growth opportunities and the ongoing operational costs”. These include the 2ndVote Life Neutral Plus ETF which invested in stocks that meet its pro-life social criteria, and the 2ndVote Society Defended ETF which invested in stocks that meet its 2nd Amendment and border security social criteria.

One ETF that is considered by many to be a “liberal” ETF is the SPDR MSCI ACWI Climate Paris Aligned ETF (NZAC). It is for “investors seeking to implement net-zero strategies and address climate change in a holistic way”. The ETF is up 21%.

The year 2024 should be an interesting year, not just for politics and the election, but for the political ETFs.

Disclosure: Author didn’t own any of the above at the time the article was written.