If you have a spare hour and a half, you should watch the Elon Musk interview. It is well worth watching. He covers a lot of topics, including Disney, unions, Tesla, X.com, and many others.

Check it out:

WStNN.com™ WallStreetNewsNetwork® Stockerblog™ WSNN®

Wall Street News Network: Information on stocks, bonds, real estate, investments, gold, startups, & money

by Fred Fuld III

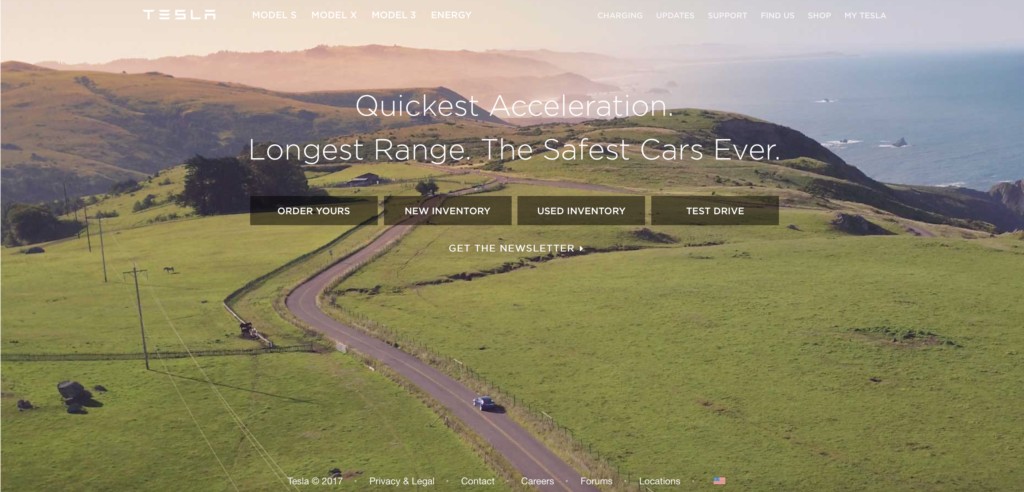

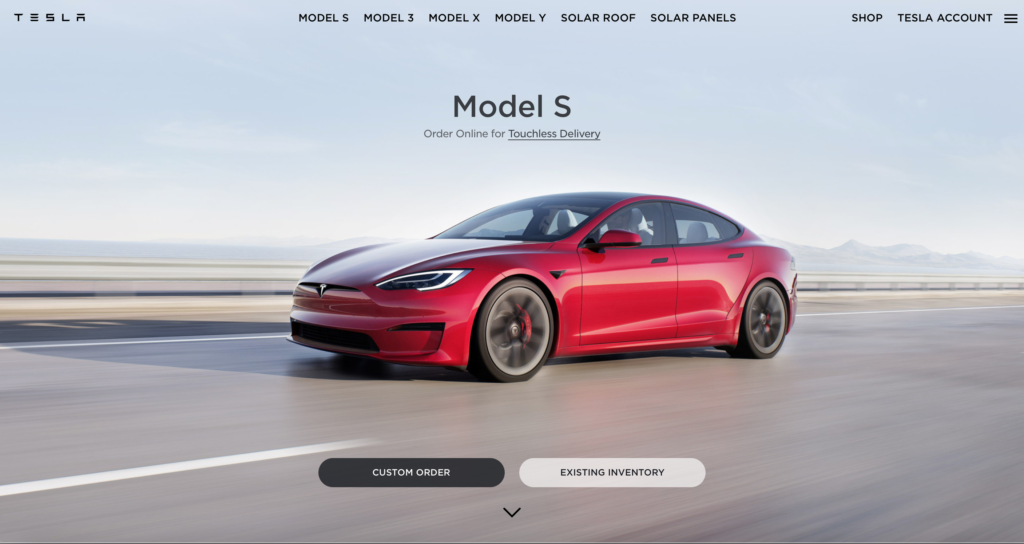

Have you ever wondered what the old websites look like for various companies? The Tesla.com website has had a few dramatic changes over the years, because for a long time, the domain name wasn’t even owned by Elon Musk’s Tesla (TSLA) company.

The following shows what the old home pages looked like for Tesla.com:

Tesla Year: 2002

Tesla Year: 2008

Tesla Year: 2010

Tesla Year: 2013

Tesla Year: 2016

Tesla Year: 2017

Tesla Year: 2021

Screenshots are courtesy of the WaybackMachine.

Disclosure: Author owns TSLA

AXS Investments Launches First-Ever U.S. Suite of Single-Stock Leveraged Bull and Bear ETFs

by Fred Fuld III

Recently I wrote an article called 10 Ways to Make Money in a Bear Market. Well, now there is an additional way. You can now buy a single stock bearish ETF for certain stocks.

AXS Investments, a leading asset manager providing access to alternative investments for growth, income and diversification, today, July 14, 2022, launched a suite of eight ETFs that seek to provide leveraged long or inverse exposure to the daily performance of some of the most actively traded stocks across a variety of sectors.

“We are thrilled to be the first firm to bring single-stock leveraged and inverse ETFs to U.S. investors,” said Greg Bassuk, CEO of AXS Investments. “With the launch of this highly innovative family of ETFs, AXS has once again opened new access for traders and sophisticated investors, namely to express their high-conviction views on some of the most actively traded single stocks, regardless of whether their sentiment is bullish or bearish. AXS is excited to continue our aggressive build-out of highly differentiated ETFs designed to provide investors with unique, first-of-their-kind investments to achieve their varying objectives.”

The initial suite of AXS single-stock ETFs provides investors with leveraged long (“Bull”) and short (“Bear”) daily exposure to the following stocks:

• Tesla: AXS TSLA Bear Daily ETF (TSLQ)

• NVIDIA: AXS 1.25X NVDA Bear Daily ETF (NVDS)

• PayPal: AXS 1.5X PYPL Bull Daily ETF (PYPT) and AXS 1.5X PYPL Bear Daily ETF (PYPS)

• Nike: AXS 2X NKE Bull Daily ETF (NKEL) and AXS 2X NKE Bear Daily ETF (NKEQ)

• Pfizer: AXS 2X PFE Bull Daily ETF (PFEL) and AXS 2X PFE Bear Daily ETF (PFES)

As you can see, some of these ETFs have a leveraged bearish goal, such as Pfizer, which has a goal of providing two times the inverse of the daily performance of the price of the stock.

AXS Continues to Expand Fund Lineup with Fast-Growing Suite of First-of-Their-Kind Strategies.

Today’s rollout of these new ETFs is just one of many major strategic growth initiatives successfully achieved by AXS.

“Whether it is powerful inflation fighting tools, ways to express views on innovation, or a host of other novel investments that previously were unavailable to investors, our goal remains to be the leader in providing investors with access to the tools needed to build portfolios and to trade effectively in today’s volatile markets,” continued Bassuk. “We’re very excited about today’s news, and all that we still have in our product pipeline for 2022 and beyond.”

by Fred Fuld III

Elon Musk is involved in a lot of businesses, including Tesla (TSLA), the Boring Company, SpaceX, and Neuralink, and almost became the head of Twitter (TWTR).

However, many investors don’t realize that Musk has been on the Board of Directors of a company called Endeavor Group Holdings, Inc. (EDR).

In addition, Elon Musk owns 7,583 shares of Endeavor Group Holdings, according to a recent SEC Form 4 filing.

Musk has been a director of the company since its IPO, but has resigned as of June 30.

So what is this Endeavor Group Holdings?

Endeavor, formerly named William Morris Endeavor Entertainment, is located on Wilshire Boulevard in Beverly Hills.

It is an entertainment conglomerate. It owns such businesses as UFC, the talent management company IMG, Professional Bull Riders, Miss Universe, and nine Minor League Baseball Teams.

The company has a market cap of $6.2 billion, and a sky high price to earnings ratio of 730. However, it does have a reasonable price sales ratio of 1.10.

Revenues year-over-year have gone from $3.48 billion in 2020 to $5.08 billion in 2021.

The Endeavor Talent Agency launched in 1995. In 2009, WMA and the Endeavor Talent Agency merged to form William Morris Endeavor, or WME.

Endeavor executives Ari Emanuel and Patrick Whitesell became co-CEOs.

On April 28, 2021, Endeavor Group went public on the New York Stock Exchange.

Disclosure: Author has a short option position in TSLA.

by Fred Fuld III

By now, you should have heard the news. Elon Musk, the head of Tesla (TSLA), has decided to cancel his acquisition of Twitter (TWTR).

Musk is claiming that Twitter is in material breach of multiple provisions of the agreement, and has also claimed that the company has more bot accounts than what Twitter claims it has.

Musk originally agreed to buy the company at $54.20 a share. Twitter stock is now down to 35.04 in after-market trading as of last Friday, July 8, 2022.

Do you want to see the actual letter dated July 8 that Elon Musk sent to Twitter’s chief legal officer through Musk’s attorney? Here is the link:

Elon Musk Letter from his Attorneys Canceling the Twitter Acquisition

by Fred Fuld III

Yesterday, Piedmont Lithium (PLL) spiked 236% on the news that the company made an agreement with Tesla (TSLA) to supply lithium for batteries.

News of the deal caused other lithium mining stocks to escalate yesterday, such as Lithium Americas (LAC) up 27.5%, Sociedad Quimica y Minera (SQM) up 4% and Livent (LTHM) up 5.8%.

Lithium is one of the critical components of batteries used in electric vehicles, which has created a huge demand for this element. It is the lightest metal and the lightest solid element. Interestingly, it is also used for psychiatric medication.

The following stocks are involved in the production of lithium.

| COMPANY | SYMBOL | MKT CAP in millions |

| Albemarle | ALB | 9,198 |

| Sociedad Quimica y Minera | SQM | 8,199 |

| Livent | LTHM | 1,295 |

| Lithium Americas | LAC | 945 |

| Orocobre | OROCF | 571 |

| Pilbara | PILBF | 498 |

| Galaxy Resources | GALXF | 322 |

| Piedmont Lithium | PLL | 314 |

| American Lithium | LIACF | 70 |

| American Battery Metals | ABML | 52 |

| Power Metals | PWRMF | 28 |

One of these stocks might give your portfolio a charge.

Disclosure: Author didn’t own any of the above at the time the article was written.

by Fred Fuld III

by Fred Fuld III

Yesterday, the Tesla (TSLA) Annual Shareholders Meeting was held at the Computer History Museum in Mountain View, California. After the official part of the meeting, which took about 15 minutes, Elon Musk came out and spoke to the large crowd of attendees, along with showing a slide presentation. There was also a question and answer period after the speech.

For the last four quarters, Tesla has been outselling all competitors combined. The Model 3 is the best selling car by revenue of any car and is outselling all direct competitors combined.

The Model S has a range of 370 miles and the Model X has a 325 mile range.

Currently, the company does not have a demand problem. Sales far exceed production. In addition, 63% of trade-ins are non-premium cars.

The total cost of ownership of Teslas is much less than gasoline cars, when you take into consideration maintenance and other costs.

Every Tesla produced since October has the ability of full autonomy with just a switch out of the computer.

Buying a non-electric car without autonomous capability is like “Riding a horse using a flip phone.”

Buying a non-electric car without autonomous capability is like “Riding a horse using a flip phone.”

Elon Musk spent a lot of time discussing the gigafactories, the solar roofs, batteries, and the V3 Superchargers.

He also mentioned the Mobile Service that can even handle minor repairs.

Numerous questions and suggestions were offered as that last part of the meeting, with Musk responding thoroughly to each one.

Disclosure: Author owns TSLA.

by Fred Fuld III

During the last month, the stock price of Tesla (TSLA) has increased by 23.9%. This is in spite of the fact that the company hasn’t generated any earnings. Many believe that the reason for the price rise in the stock is due to a short squeeze, as over 39 million shares have been shorted, amounting to 31% of the stock float. When the stock rises for any reason, short sellers scramble to cover their positions by buying the stock, and thereby driving up the price of the stock even more.

So how can you make money on the long side from short squeezes? One technique that stock traders utilize is buying short squeeze stocks, companies have been heavily shorted. Here is a more extensive explanation of what a short squeeze is.

When you short a stock, it means that your goal is to make money from a drop in the price of a stock. Technically what happens is that you borrow shares of a stock, sell those shares, then buy back those shares at a hopefully lower price so that those shares can be returned. This all happens electronically, so you don’t actually see all the borrowing and returning of shares; it just shows up on your screen as a negative number of shares.

Short sellers can be profitable, but sometimes when the stock moves against them, and begins to rise, the short sellers jump in right away to buy shares to cover their positions, creating what is called a short squeeze. When a short squeeze takes place, it can cause the share prices to increase fast and furiously. Any good news can trigger the short squeeze.

Some traders utilize this situation by looking for stocks to buy that may have a potential short squeeze. Here is what a short squeeze trader should take into consideration:

Short Percentage of Float ~ The float is the number of freely tradable shares and the short percentage is the number of shares held short divided by the float. Amounts over 10% to 20% are considered high, and potential short squeeze plays.

Short Ratio / Days to Cover / Short Interest Ratio -This is probably the most important metric when looking for short squeeze trades, no matter what you call it. This is the number of days it would take the short sellers to cover their position based on the average daily volume of shares traded. This is a significant ratio as it shows how “stuck” the short sellers are when they want to buy in their shares without driving up the price too much. Unfortunately for the shortsellers, the longer the number of days to cover, the bigger and longer the squeeze.

Short Percentage Increase ~ This is the percentage increase in in the number of short sellers from the previous month.

Here is one example. Big Lots (BIG) is a stock that is heavily shorted. As a matter fo fact, 30.6% of the float is shorted. In addition, the number of shares shorted has increased by 6% over the last reported two week period. Finally, the short interest ratio is 9. That means it would take the short sellers nine days to cover their positions, based on the number of shares that trade each day on average.

So what stocks are heavily shorted that may be worth a closer examination? Check out the following list, but be aware, that often some stocks are heavily shorted for a reason.

| Company | Symbol | % change | % of Float | Days to cover |

| Big Lots | BIG | 6 | 30.6 | 9.0 |

| Ichor | ICHR | 0 | 33.2 | 6.7 |

| Mallinckrodt | MNK | 0 | 39.4 | 13.6 |

| Renewable Energy | REGI | 12 | 27.4 | 7.4 |

| Abercrombie & Fitch | ANF | 2 | 22.0 | 5.8 |

Maybe this is a way to squeeze some juice out of your portfolio.

Disclosure: Author owns TSLA.

by Fred Fuld III

The Tesla (TSLA) annual meeting was packed with shareholders yesterday. at the Computer History Museum on North Shoreline Blvd. in Santa Clara, California. I arrived an hour and a quarter early and the long line to get in through security was already lined up all across the very wide building.

Outside the entrance were the latest Tesla vehicles, including the Tesla Semi truck. But the one that attracted the most interest was the new Tesla Roadster.

Outside the entrance were the latest Tesla vehicles, including the Tesla Semi truck. But the one that attracted the most interest was the new Tesla Roadster.

By the time the meeting started, it was standing room only. The official part of the meeting went quickly, and the corporate voting results were in line with what the directors recommended.

Once that was done, Elon Musk came out and gave a presentation, which included a question and answer session at the end.

Musk began by saying that of all American car companies, only two haven’t gone bankrupt, Ford and Tesla. He initially pointed out that he expects Tesla to be producing 5,000 cars a week by the end of this month.

He discussed the market share of the Model 3 and said that it is the best selling midsize of any kind, not just electric or hybrids. He also expects to be producing lower cost cards by the end of the year.

He discussed the market share of the Model 3 and said that it is the best selling midsize of any kind, not just electric or hybrids. He also expects to be producing lower cost cards by the end of the year.

He mentioned that employee safety is an important issue for him and that the company’s injury rates are 6% below the industry average year to date. It has a 50% decrease in the injury rate from the final years of NUMMI (the Toyota GM partnership). Most of the injuries are due to repetitive stress, such as back strain, and the company is working on that issue by rotating employees through different roles.

Tesla currently has 9,969 superchargers worldwide. The company has 1 gigawatt of cumulative energy storage deployment year-to-date, and expects another gigawatt in less than a year, with each year being the combined sum of future years.

Tesla ships more battery capacity than all the other EVs combined.

SolarCity is now installing its first solar roofs, where the entire roof is made up of roofing materials that are solar panels. They are still under evaluation because the company wants to be sure that they will last 30 years.

SolarCity is now installing its first solar roofs, where the entire roof is made up of roofing materials that are solar panels. They are still under evaluation because the company wants to be sure that they will last 30 years.

The company is expecting positive GAAP net income and positive cash flow in the third and fourth quarter. In addition, Musk has no plans for incremental debt or equity funding.

The Model Y production will begin next year.

The Tesla Semi is being developed. The company is working on obtaining acceptance in countries around the world.

The Tesla Roadster can outperform any gas car in every way. Musk said that they are even offering a “SpaceX Option Package”.

The Tesla Roadster can outperform any gas car in every way. Musk said that they are even offering a “SpaceX Option Package”.

The gigafactory is one third completed and will be completed in four to five years. At that time, it will be the biggest building in the world. Everyone will be produced in it: the vehicle, battery pack, and powertrain.

Tesla is also working on setting up its first gigafactory outside the US, which will be built in China. The next one will be built in Europe, with an ultimate goal of 10 to 12 worldwide.

Everything is recycled and the company is spending more on R&D to improve recycling, especially in the gigafactories.

In regards to insurance, Tesla is getting the cost of insurance lower than the BMW 3 Series.

The waiting time for the Model 3 in the US is three to four months, however, the right side driver models have a waiting period over a year. Test driving the Model 3 should be available by the end of the month.

Musk expects to have ten Tesla body shop repair locations by the end of the month, with same day repair service for many of them, which will have restocked parts.

Tesla expects to have a compact car in less than five years.

Tesla is enhancing the Tesla app. It can already change the temperature of your car before you get in it, but Musk wants the app to anticipate your needs as if it was a chauffeur.

Musk has no plans to make motorcycles, due to an accident he was in when he was young.

One amusing incident was a question that was asked by a member of an animal rights group. She asked if leather could be removed from the gear stick shift and the steering wheel. So Musk said, “Stick shift? What’s that?”

Disclosure: Author is a shareholder of TSLA.