by Fred Fuld III

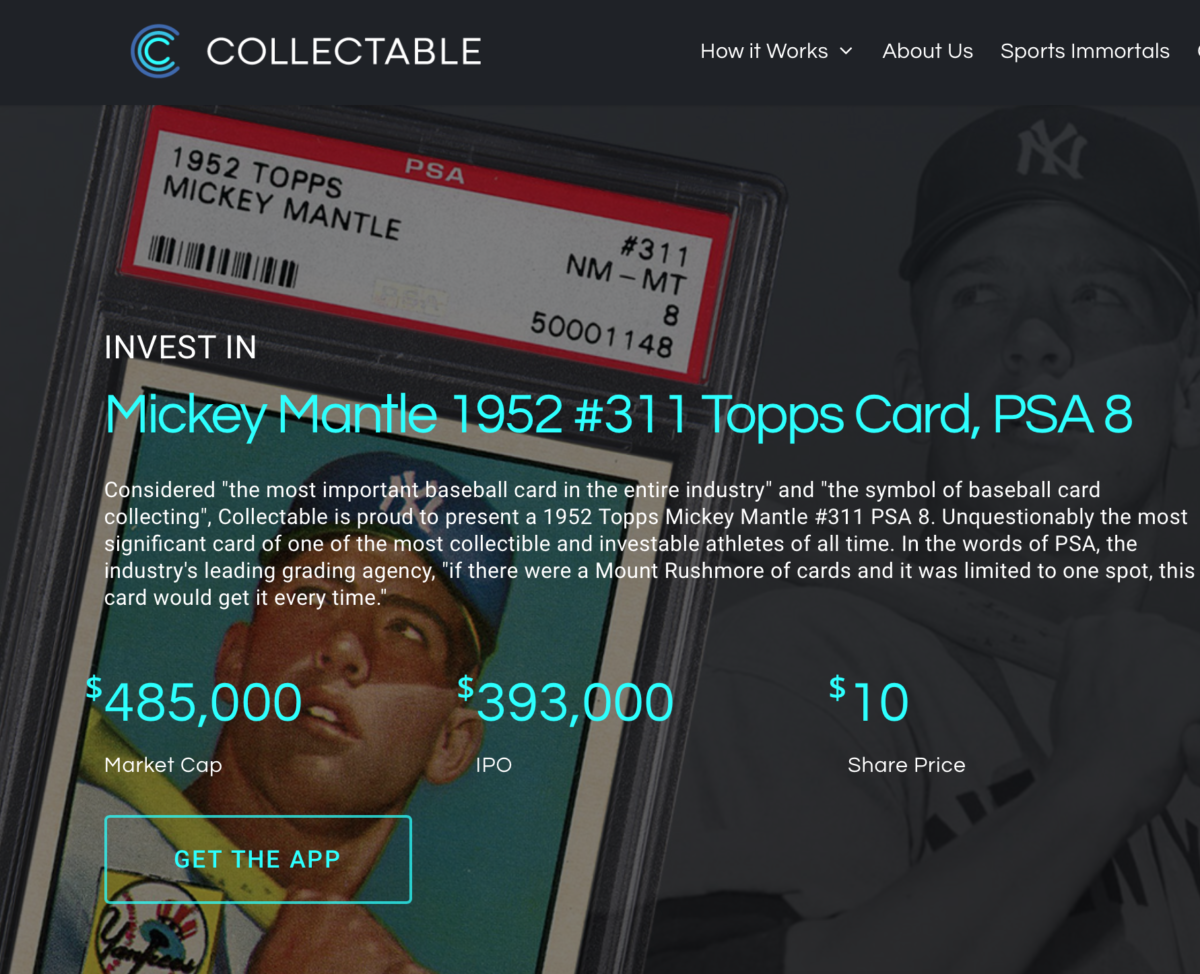

Did you ever think that maybe you should put a little of your investment portfolio into sports cards?

After hearing about the latest Heritage Auctions result, you might want to consider it. However, make sure you go for the rare items.

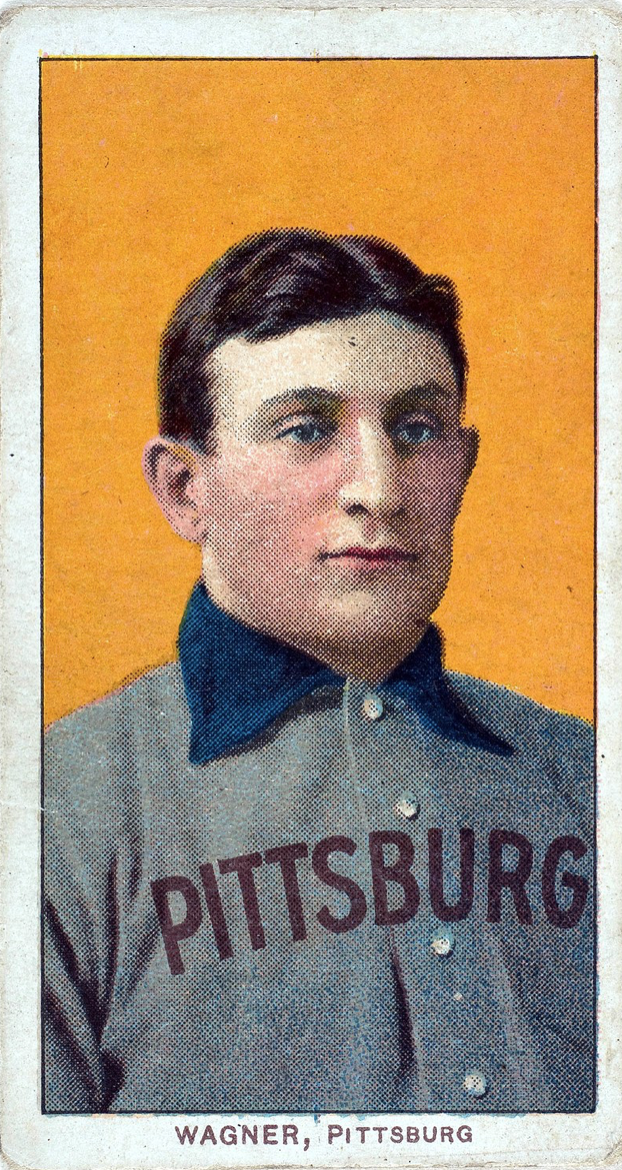

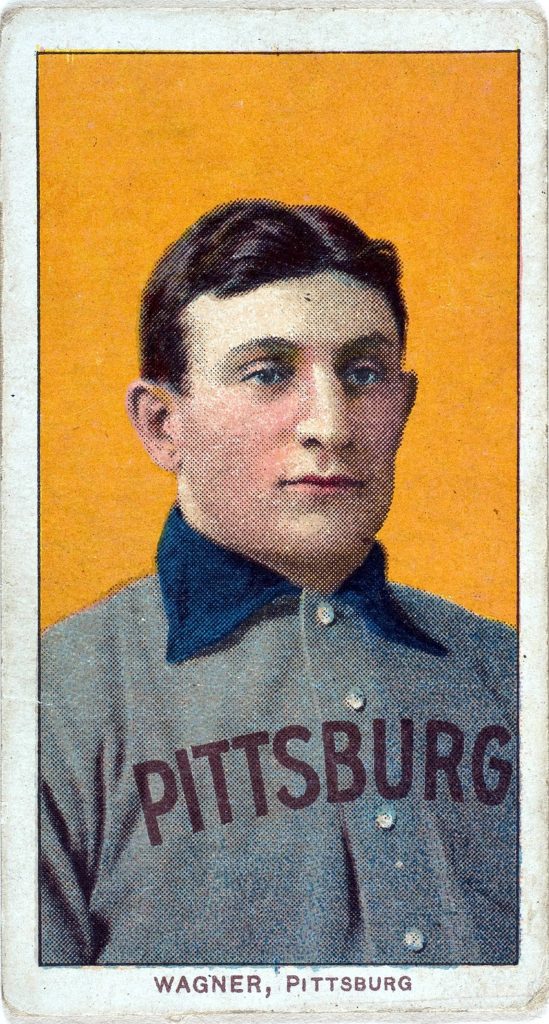

A 1952 Mickey Mantle baseball card was hammered at an amazing $12.6 million, setting a world record.

This 1952 Topps Mickey Mantle #311 SGC Mint+ 9.5 card was described as “Finest Known Example!”.

In addition, Heritage announced that there will be a documentary made about the card called “Four Perfect Corners” by Emmy-Award winning director Dan Klein.

Mickey Mantle:

• Second highest career OPS+ among center fielders

• Highest stolen-base percentage in history at the time of his retirement

• Lowest career rate of grounding into double plays

• Highest World Series on-base percentage and World Series slugging percentage

• .984 fielding percentage when playing center field

• Hit 536 career home runs

• Batted .300 or more ten times

• Only player in history to hit 150 home runs from both sides of the plate.

• 16th all-time in home runs per at-bats

• 17th in on-base percentage

• MVP award three times, finished second three times, and finished within nine votes of winning five times.

When investing in collectables, make sure you stick with the scarce and rare items, and the items that you are personally interested in.

Don’t forget to check out the related articles:

The $5 Million Michael Jordan Jersey