by Fred Fuld III

Whether you spell it collectable or collectible, there is a great fascination with collecting and some of those collections turn out to be great investments.

Investing in collectibles, such as artwork, rare coins, stamps, vintage cars, or sports memorabilia, can have both advantages and disadvantages. Let’s explore them:

Advantages of investing in collectibles:

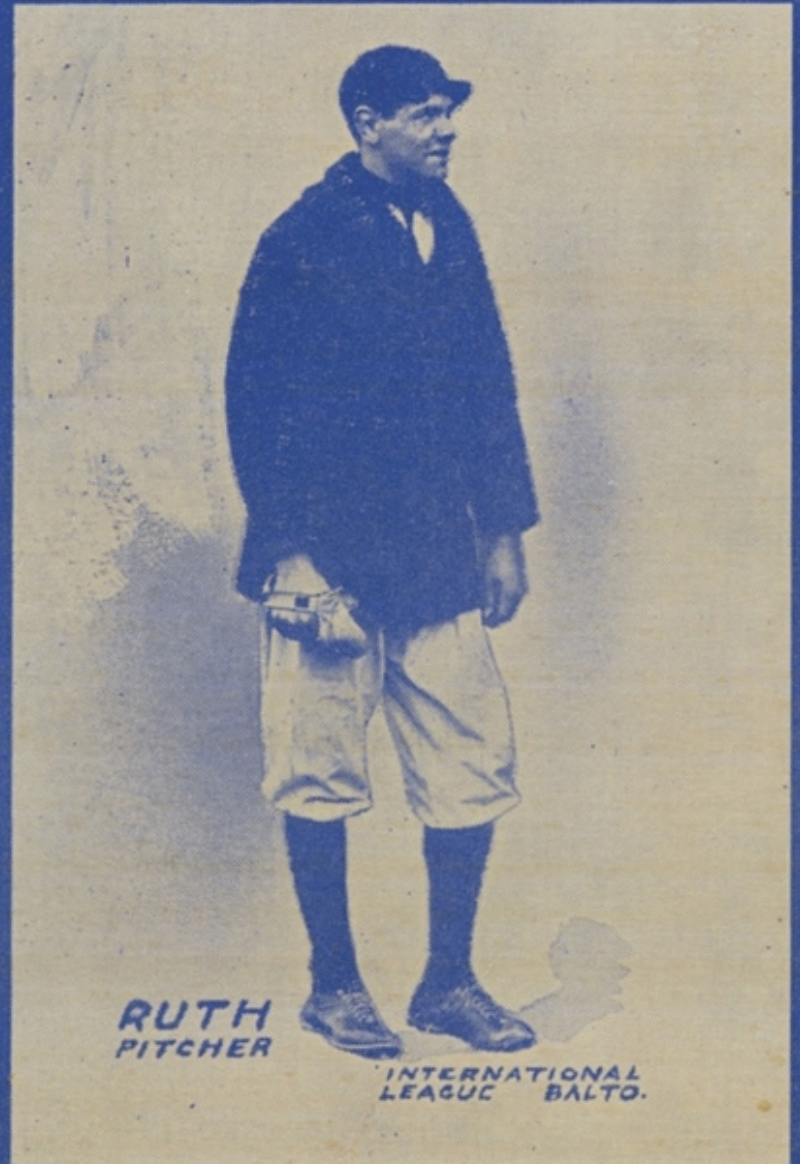

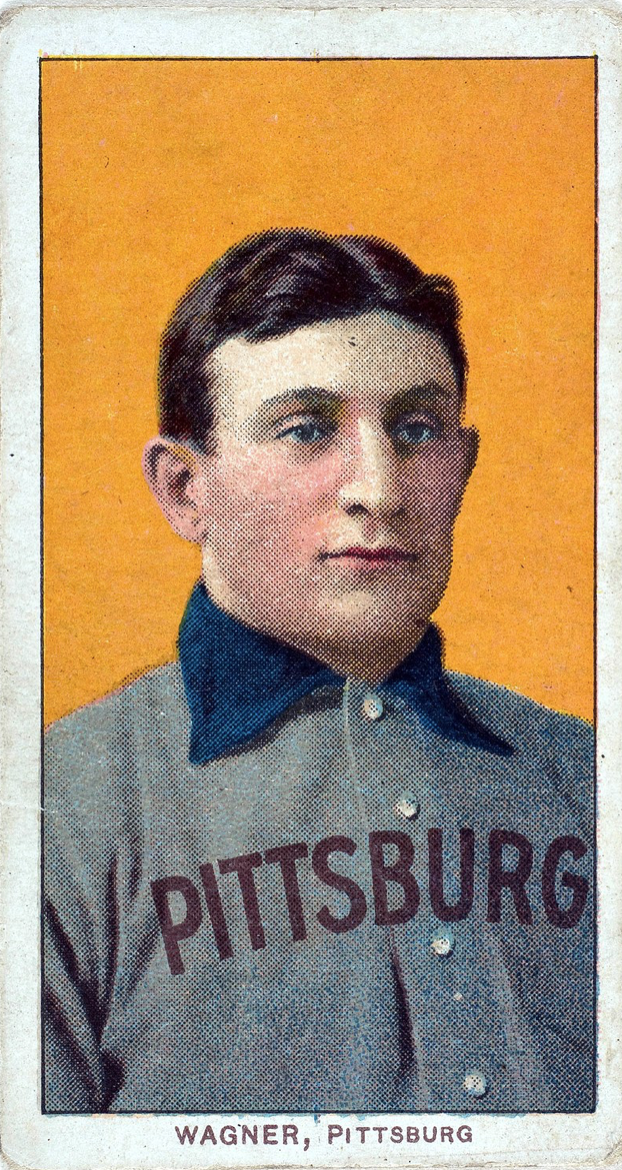

- Potential for high returns: Some collectibles can appreciate significantly in value over time, especially if they are rare or in high demand. For example, certain pieces of art or rare coins have fetched enormous prices at auctions.

- Diversification: Collectibles can be an alternative investment that diversifies your portfolio beyond traditional assets like stocks and bonds. They may have a low correlation with the stock market, which can provide a hedge against market volatility.

- Tangible assets: Unlike stocks or other financial investments, collectibles are tangible assets that you can physically enjoy. Owning a valuable piece of art or a classic car can bring aesthetic pleasure and emotional satisfaction, in addition to potential financial gains.

- Privacy and autonomy: Collectibles can be stored privately, offering a level of anonymity and independence from financial institutions or regulatory bodies that govern traditional investments.

Disadvantages of investing in collectibles:

- Illiquid assets: Collectibles are often illiquid, meaning they can be difficult to sell quickly, especially at a fair price. Finding a buyer who is willing to pay the desired price may take time, which can limit your ability to access funds when needed.

- Lack of income generation: Unlike stocks or rental properties that can generate regular income through dividends or rent, most collectibles do not generate any ongoing income. Their value is primarily determined by the buying and selling market.

- Volatile market: The collectibles market can be highly volatile and subject to fluctuations in demand. The value of collectibles is often subjective and influenced by factors such as trends, popularity, and changing tastes. Market sentiment can greatly impact prices, making it challenging to predict or control investment outcomes.

- Expertise and authenticity risks: Investing in collectibles requires specialized knowledge to accurately assess the authenticity, condition, and value of items. Without proper expertise, there is a risk of purchasing counterfeit or overpriced collectibles, potentially leading to financial losses.

If you are a Disney (DIS) fan, Van Eaton Galleries will be auctioning The Joel Magee Disneyland Collection, the largest privately owned collection of Disney Parks memorabilia in the world. There are over 1500 Disneyland items on July 17, 2023 through the 19th. The auction offers everything from a Disneyland Security Officer badge to a One of a Kind Hitchhiking Ghosts Animatronic Display with an estimate of $100,000 to $200,000.

If that’s too rich for your blood, you can pick up Peter Pan’s Flight Original Attraction Vehicle with n estimate of $75,000 to $100,000.

The item with the lowest start price is a Disneyland Donald Duck Birthday Squeaker Hat with a starting bid of $20 and an estimate of $100 to $200.

For you music fans out there, you can get Tupac Shakur’s inscribed Gold, Ruby, and Diamond Crown Ring, designed and commissioned by him in 1996. The estimate is $200,000 to $300,000. It is being offered by Sotheby’s on July 18.

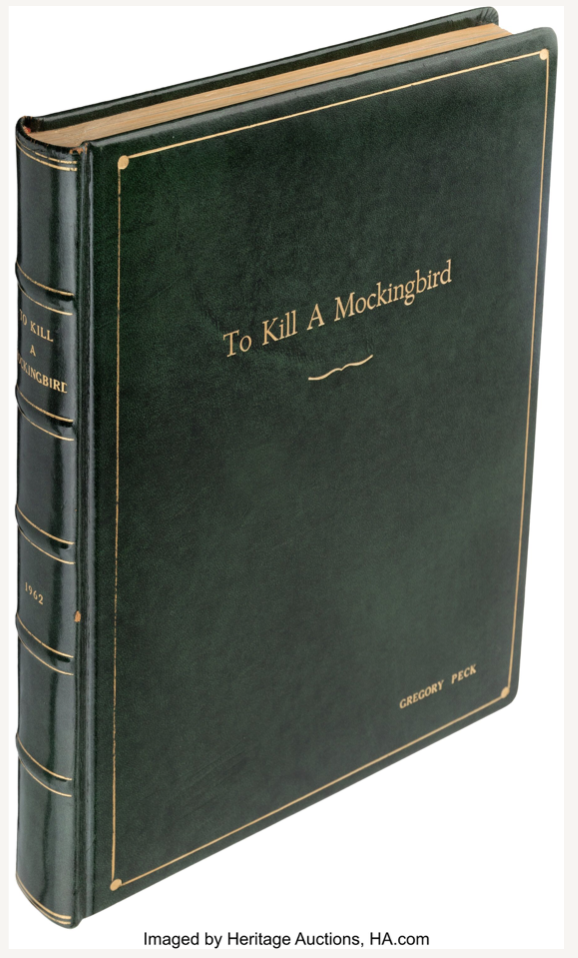

If you enjoyed watching M*A*S*H, Heritage Auctions is offering Alan Alda’s “Capt. Benjamin Franklin ‘Hawkeye’ Pierce” Screen Used Dog Tags and Boots from MAS*H. It is currently bid at $11,500 and closes on July 28.

It’s important to note that investing in collectibles carries inherent risks, and outcomes can vary significantly based on individual items, market conditions, and personal expertise. It’s advisable to research thoroughly, seek professional advice, and diversify your investment portfolio appropriately to manage risks effectively.