by Fred Fuld III

During the last month, I bought a racehorse, an NFT, and a collectable baseball card. I’m even considering buying modern art. All of these are generating extremely high prices, along with many other collectables, such as old hats.

So do these high prices predict an upcoming burst of a bubble, not just in the collectibles market but all financial assets?

Racehorses

Let’s talk about what I bought. First the racehorse. I actually didn’t buy the whole horse, I bought two one-thousanths of a horse. I guess that’s equal to one hoof. I can make a lot of money if the horse runs well.

NFTs

Second, the NFT, which stands for non-fungible token. I bought one, and I even created a couple of my own, which are listed for sale. When I have more time, I will write about the process. One thing I will mention to watch out for is the “gas tax”. If you don’t know what it is, hold off on doing any buying or selling and do some research.

If you want more background information on NFTs, you can check out some previous articles here, here, here, and here.

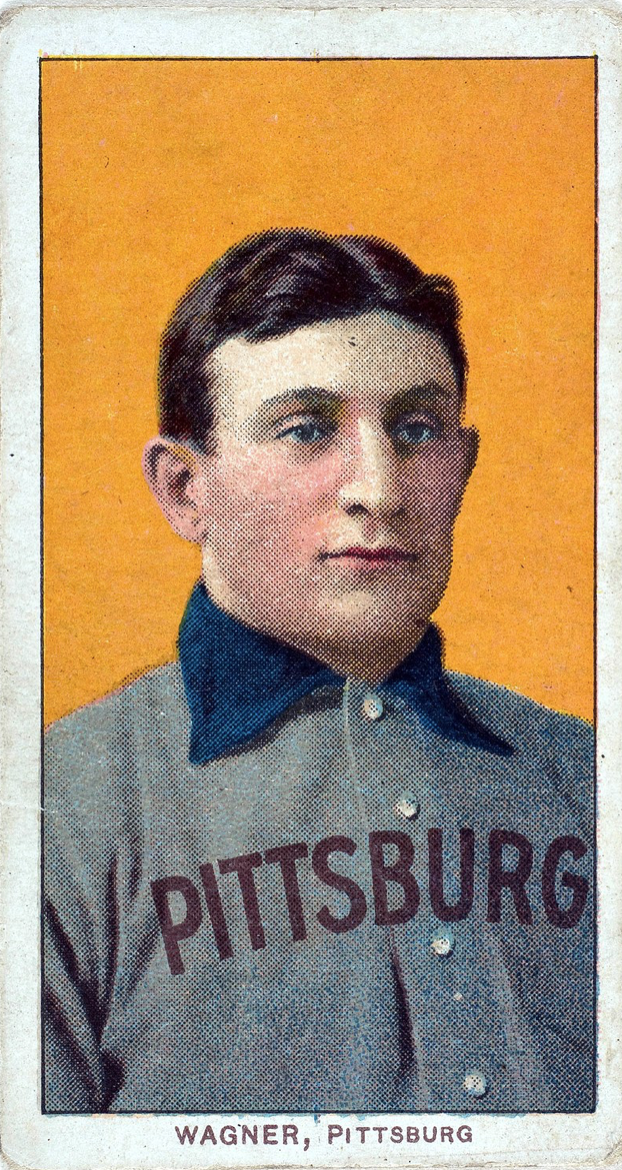

Sports Cards

As for the baseball card, I own a Mickey Mantle, a Willie Mays, a Sandy Koufax, and even a 1914 Babe Ruth.

Of course, I don’t own the entire cards, I just own shares in the card.

As an example, the Babe Ruth card is worth $6 million. The Sandy Koufax is worth $380,000.

Weird Collectables

These are actually “mainstream” collectables, almost like coins, stamps, and autographs. But some people collect some pretty bizarre items.

I know one guy why collected the pill bottles of celebrities. He would buy from autograph hounds who would go through the trash cans of famous people looking for cancelled checks, old letters, receipts, and so forth that may have a signature, and when they would come across a pill bottle which had the celebrity’s name printed on the prescription sticker, they would sell those little containers to the pill bottle collector.

Even more weird, in a collectables magazine, I saw a Wanted ad placed by a guy who wanted to buy “old mens underwear”. Now, I’m not sure whether he wanted the underwear of old men or men’s underwear that was old.

Just because collectibles may have a limited supply or just because they are old doesn’t mean they will always go up. Just look at Beanie Babies and Cabbage Patch Kids.

Collectibles Recommendations

So do any of these collectables make good investments? My long term readers know that I never make investment recommendations. However, I will make collectibles recommendations.

- Only buy what you like

- Only buy what you would like to hold for a long time

- Never buy a collectable with the anticipation of selling at a profit

- Buy quality, not quantity

Happy collecting!

Note: Collectable and Collectible are used interchangeably. Numerous sources can’t agree on which is correct for items that people collect.