| CEF | Symbol | Discount | Yield | Dividend |

| Foxby | FXBY | -38% | 0.5% | Annually |

| Herzfeld Carribean Basin | CUBA | -26% | 16.7% | Quarterly |

| Central Securities | CET | -18% | 1.4% | Semi-Annually |

| General American Investors | GAM | -18% | 1.1% | Annually |

| Eagle Capital Growth | GRF | -17% | 7.7% | Annually |

| Boulder Growth & Income | BIF | -16% | 4.0% | Quarterly |

| Royce Micro-Cap Trust | RMT | -16% | 7.4% | Quarterly |

| Miller/Howard High Income Equity | HIE | -14% | 7.2% | Monthly |

| Adams Diversified Equity | ADX | -14% | 1.2% | Quarterly |

| Sprott Focus Trust | FUND | -14% | 6.8% | Quarterly |

| Gabelli Dividend & Income | GDV | -13% | 6.8% | Monthly |

| Royce Value Trust | RVT | -13% | 7.5% | Quarterly |

Tag: Cuba

Top Performing Stock Motifs Up over 30% (like mini ETFs)

by Fred Fuld III

Motifs are similar to Exchange Traded Funds, but any investor can create them. An investor can choose the stocks they want for the Motif portfolio, or even better, the investor can invest in the Motifs created by others for a low commission rate. I have created many motifs that are available for anyone to invest in, a few of which are up over 100% since inception.

Here are some of the motifs I created and the returns since inception (created about a couple years ago). You will notice that some are up over 100%.

Anti-Crime Stocks +37.0%

Liquid Biopsy Stocks +227.9%

Stem Cell Stocks +344.0%

Firearms Stocks +12.9%

Gisele Bundchen Stocks +41.1%

Water Desalination +36.7%

Drone Stocks +53.3%

Cuba Stocks +23.1%

Puerto Rico Stocks +88.3% (in spite of the hurricane)

Marijuana Cannabis Stocks +81.3%

Horse Race Stocks +74.1%

Cosmetic Surgery Stocks +168.8%

Beer Stocks +29.2%

Wine and Liquor Stocks +22.5%

Virtual Reality Stocks Over $5 +25.5%

Virtual & Augmented Reality Stocks +56.3%%

If you are searching for specific industries to invest in, Motifs might be the way to go.

My Top Performing Stock Motifs: Some Up Over 100%

by Fred Fuld III

Motifs are like Exchange Traded Funds, except they can be created by anyone. Investors gets to choose which stocks they want to put in the portfolio, or better yet, they can invest in the Motifs created by others for a low commission. I created several motifs that are available for anyone to invest in, a few of which are up over 100% since inception.

Here are some of the motifs I created and the returns since inception (created less than two years ago):

Bitcoin, Blockchain, and Cryptocurrency Stocks +15.3%

Anti-Crime Stocks +38.8%

Liquid Biopsy Stocks +90.6% (created just a little over a year ago)

Stem Cell Stocks +100.5% (up 48.3% just in the last 12 months)

Firearms Stocks +26.6%

Gisele Bundchen Stocks +22.6%

Water Desalination +13.6%

Drone Stocks +53.9%

Cuba Stocks +26.1%

Puerto Rico Stocks +49.4% (one-year return in spite of the hurricane)

Marijuana Cannabis Stocks +82.5%

Horse Race Stocks +188.7% (top performing)

Cosmetic Surgery Stocks +141.0% (second best performing, up 56.1% just in the last 12months)

Beer Stocks +26.5%

Wine and Liquor Stocks +22.4%

Virtual Reality Stocks Over $5 +79.8%

Virtual & Augmented Reality Stocks +74.0%%

So if you are looking for a targeted way of investing, Motifs may be the way to go.

Stock Motifs That Are Up Over 20%

If you have never checked out a stock motif, maybe it’s time you did. A motif is similar to an exchange traded fund or ETF that is created by an individual investor. The motif may contain five stocks or fifty stocks or any number of stocks, and are usually concentrated around a particular industry or investment idea.

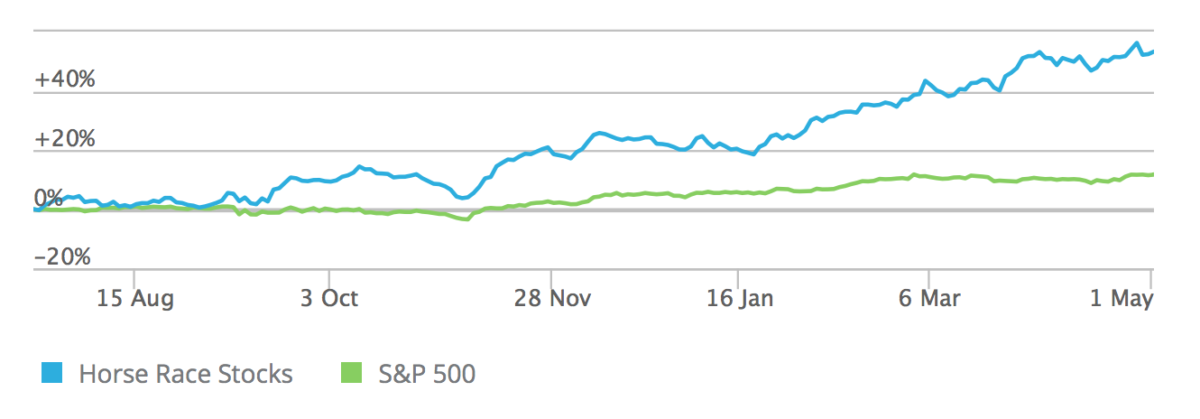

These motifs can be bought and sold, just like any other ETF, with a commission of only $9.95. Several of these motifs have significantly outperformed the S&P 500.

For example, I created a motif called Horse Race Stocks. This is a motif that contains stocks involved in the hope racing arena. It is interesting to note that this motif is up over 50% since its inception, which was less than a year ago. I created the motif on July 21, 2016 and as of today, the motif has increased by 52.5%. Not a bad return for less than ten months.

My Cuba Stocks motif which holds stocks of companies that should benefit from the opening of relations with Cuba is up 24.2% since the end of July last year.

The Marijuana Cannabis Stocks motif is my most popular. The stocks in the portfolio are self-explanatory, and with legalization of medical marijuana and recreational marijuana, what motif has spiked by 25% in less than a year.

Even a couple other motifs that haven’t performed as well, still have double digit returns, such as Drone Stocks, with a boost of 14%, and Virtual & Augmented Reality Stocks, up 17.9%.

All of the stocks in all of the above motifs sell for at least $5 a share. Also, if dividends are paid by any of the stocks, your account is credited with the payments.