by Nkem Iregbulem

Horseracing fans have now seen or heard about Thoroughbred horse Justify’s most recent win at the Belmont Stakes race this past Saturday, June 9th. Just a couple weeks before, Justify won the Kentucky Derby on May 5th and the Preakness Stakes race on May 19th. With this third exciting win, Justify was crowned the 2018 Triple Crown winner – only the second Triple Crown winner in the last 40 years.

Even with Justify’s strong performance, Secretariat, the Triple Crown winner in 1973, still holds the time records in all three Triple Crown races. These three races are the Kentucky Derby, Preakness Stakes, and Belmont Stakes. They all occur annually, and the Triple Crown is awarded to the 3-year-old Thoroughbred horse that wins all three races in a given year. It is widely considered the highest honor that a racehorse can receive.

Before the Triple Crown became an official award, the term “triple crown” was first used by TheNew York Timesin 1923 and was then regularly used by the paper’s racing columnist at the time by 1930. However, by 1937, other writers and publications adopted the term, and the term became more established.

The Belmont Stakes is the oldest and longest of the three, and the Kentucky Derby is the youngest. Started in 1867, the Belmont Stakes race is 1.5 miles long and occurs at Belmont Park in Elmont, New York on the first or second Saturday in June. The winner of this race is covered with a blanket made of hundreds of carnations and receives the August Belmont Trophy. Started in 1873, the Preakness Stakes race is 1.1875 miles long and occurs at the Pimlico Race Course in Baltimore, Maryland on the third Saturday of May.The winner of this race is covered with a blanket of black-eyed Susan flowers, so the race is otherwise known as “The Run for Black-Eyed Susans.” The winning horse also receives the Woodlawn Vase.

Begun in 1875, the Kentucky Derby race is 1.25 miles long and occurs at the Churchill Downs racetrack in Louisville, Kentucky on the first Saturday of May. The winner of this race receives the Kentucky Derby Trophy and a blanket of roses, giving the race the nickname “The Run For the Roses.” There have been 13 Triple Crown winners crowned since the creation of the award in 1950 with the first winner being Sir Barton.

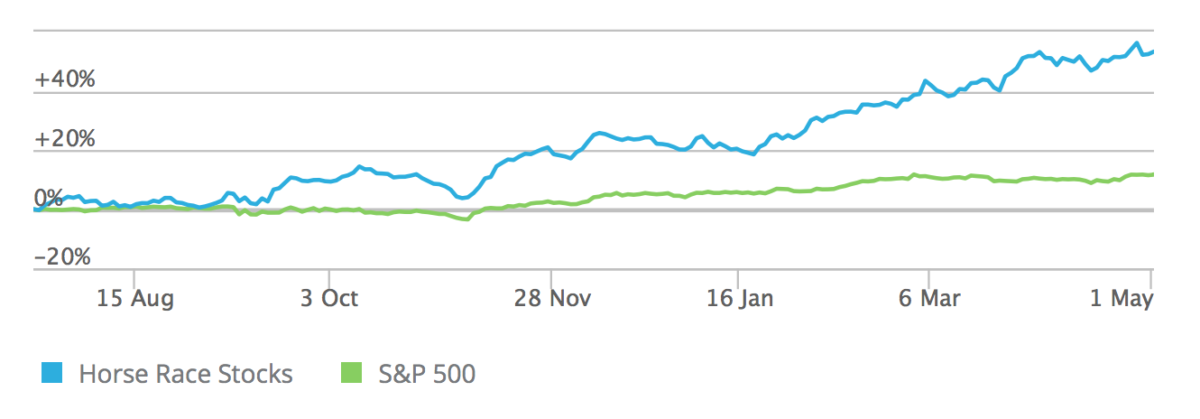

If you’re looking to get financially involved in the horse racing industry, you can choose from a variety of racing-related companies to invest in: Churchill Downs Inc. (CHDN), Dover Downs Gaming and Entertainment (DDE), and Penn National Gambling Inc. (PENN). The CHDN and PENN stocks are both listed on the NASDAQ exchange, but the DDE stock is traded on the New York Stock Exchange.

Founded in 1928 and therefore the oldest of the three companies, Churchill Downs is a racing, gaming, and online entertainment company based in Louisville, Kentucky. It hosts the Kentucky Derby at its Churchill Downs racetrack. Its other racetracks include the Arlington International Race Course in Arlington Heights, the Fair Grounds Race Course in New Orleans, and the Calder Race Course in Miami Gardens. The company also operates some casinos and hotels around the country. Most of the company’s revenue comes from within the United States.

Churchill Downs has a market cap of $4.07 billion and pays a small dividend yield of 0.51%. With a price-to-sales ratio of 5.21, its stock is considered pretty overpriced. It trades at 28.06 times trailing earnings and at 26.67 times forward earnings. The stock also has a price-to-book ratio of 12.03. Its revenue has been increasing each fiscal year since 2015 as the company enjoys a 3-year revenue growth rate of 2.81%.

Dover Downs Gaming & Entertainment Inc. is a gaming and entertainment company based in Delaware and founded in 1969. It operates its own casino, hotel, and racetrack called Dover Downs Casino, Dover Downs Hotel and Conference Center, and Dover Downs Raceway respectively. Its hotel offers conference, banquet, concert hall, and salon facilities. Its racetrack features live and simulcast horse races. However, most of the company’s revenue comes from its gaming operations.Its casino offers table games, slot machine games, poker, bars, and restaurants.

The company has a small market cap of $56.58 million, so its stock is speculative. It has a very favorable price-to-sales ratio of 0.34 and trades at 8.55 times forward earnings. It has a low price-to-book ratio of 0.53. With a negative 5-year revenue growth rate of -4.77%, the company has faced decreasing revenue values each fiscal year since 2011.

Penn National Gaming is a gaming and racing company based in Pennsylvania and founded in 1972. It stands as the second largest operator of regional casinos in the United States. In addition, it was one of the very first companies to adopt a business model, called “racino,” that combined casino operations and racetrack operations. The company has many properties scattered across the United States and Canada with three operating segments known as the Southwest, Northeast, and South/West segments.

The company has a market cap of $2.97 billion. The company’s stock has an excellent price-to-sales ratio of 0.96 and a price-to-book ratio of 9.29. It trades at 5.10 times trailing earnings and at 19.16 times forward earnings. Revenue has been increasing each fiscal year since 2014, contributing to its great 5-year revenue growth rate of 15.15%

So, if you are interested in investing in the horse racing industry, you might consider investing in the racing-related companies that you find attractive. Hopefully they turn out to be winners.

Disclosure: Author didn’t own any of the above at the time the article was written.