by Nkem Iregbulem

Although marijuana can be used recreationally, medical marijuana has become increasingly popular over recent years as a growing amount of research supports its potential health benefits. Small studies show that medical marijuana may help in treating pain, nausea, loss of appetite, irritable bowel syndrome, Parkinson’s disease, epilepsy, and multiple sclerosis. D.C. and 31 states, including California, Nevada, Maine, Massachusetts, and Washington, have legalized medical marijuana. Meanwhile, the recreational use of marijuana is legal in 9 states, including California, Alaska, Oregon, and Colorado.

On June 21, the Canadian Senate passed the Cannabis Act, which regulates the production, distribution, and sale of marijuana in Canada. These plans have set off an investment boom or “green rush” in Canada as sales of certain forms of cannabis such as fresh or dried cannabis, cannabis oil, and plants and seeds for cultivation will now become legal. Canada will be the second country, after Uruguay, to legalize the sale of recreational marijuana.

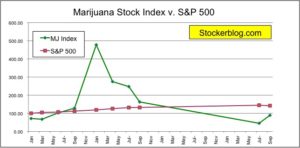

This growing interest in marijuana may compel you to invest in pot stocks. If you are looking to gain exposure to the marijuana industry, you have a number of investment opportunities: AbbVie (ABBV), Aurora Cannabis (ACBFF), Canopy Growth (CGC), Constellation Brands (STZ), Cronos Group (CRON), GW Pharmaceuticals (GWPH), Scotts Miracle-Gro (SMG), and Tilray (TLRY). The ABBV, CGC, STZ, and SMG stocks are traded on the New York Stock Exchange, and ACBFF is traded in over-the-counter markets. Meanwhile, the CRON, GWPH, and TLRY stocks can all be found on the NASDAQ.

Your first option is AbbVie, a drug company that discovers, develops, manufactures, and sells pharmaceutical products worldwide. One of its products, Marinol, is a synthetic cannabis-based drug designed to not only helps chemotherapy patients with symptoms like nausea and vomiting but also help AIDS patients with their loss of appetite. The company was founded in 2012 and is headquartered in Illinois. AbbVie has a market cap of $144 billion and pays a dividend yield of 2.3%. The company’s stock trades at 23.67 times trailing earnings and at 10.74 times forward earnings. The stock has a price-to-book ratio of 42.01, and a price-to-sales ratio of 4.93, which would put it in the overpriced range. The company enjoys a three year revenue growth rate of 12.23% and a five year revenue growth rate of 8.95%. Its revenue has been increasing each fiscal year since 2013.

Aurora Cannabis, founded in 2006, is another option to consider. The company is based in Vancouver, Canada and is involved in the production and distribution of medical cannabis in Canada and internationally. The company’s product portfolio includes dried cannabis and cannabis oil. Aurora Cannabis has a market cap of $7.54 billion and does not pay a dividend. The company’s stock trades at 546.76 times trailing earnings and at 303.03 times forward earnings. The stock has a very high price-to-sales ratio of 97.68, so it is considered overpriced. The stock also has a price-to-book ratio of 7.59. The company’s revenue has been increasing since 2015, jumping from 1.44 million to 18.07 million and then to 55.2 million over the past few years.

Headquartered in Canada and founded in 2014, Canopy Growth is a licensed producer of medical marijuana. Its product portfolio includes items like dried flowers, oils and concentrates, softgel capsules, and hemp. Canopy Growth has a market cap of $10.8 billion and does not pay a dividend. The stock’s high price-to-sales ratio of 134.27 puts it well into the overpriced category. The stock also has a price-to-book ratio of 11.71. With its revenue increasing each fiscal year since 2014, Canopy Growth boasts a 3-year revenue growth rate of 266.47% and an even higher 5-year revenue growth rate of 724.53%. Most of the company’s revenue comes from its sales of medical marijuana under two of its brands, Tweed and Bedrocan.

Constellation Brands is a large alcoholic beverage supplier in the United States that produces beer, wine, and spirits. The company bought a large stake in the previous mentioned Canopy Growth. It is currently working on creating its own cannabis-infused non-alcoholic beverage. Constellation Brands has a market cap of $40.8 billion and pays a dividend yield of 1.39%. The stock trades at 22.04 times trailing earnings and at 21.83 times forward earnings. The stock has a high price-to-sales ratio of 5.5 and a price-to-book ratio of 3.82. With its revenue increasing each fiscal year since 2014, Constellation Brands enjoys a 3-year revenue growth rate of 7.96% and an even higher 5-year revenue growth rate 22.09%. Most of the company’s revenue come from its sales within the United States.

You might also consider Cronos Group, another cannabis company involved in the production and distribution of marijuana in countries such as Canada, Germany, and Australia. It sells dried cannabis and cannabis oils under its brand Peace Naturals. The company is headquartered in Toronto, Canada and was founded in 2012. Cronos Group has a market cap of $2.36 billion and does not pay a dividend yield. The stock trades at 917.86 times trailing earnings and at 129.87 times forward earnings. The stock has a price-to-book ratio of 10.68 and a very high price-to-sales ratio of 349.40. The company has seen increasing revenue values each fiscal year since 2015.

Based in the United Kingdom and founded in 1998, GW Pharmaceuticals is a biopharmaceutical company that researches and develops cannabinoid products for use in different disease areas. One of its products, Epidiolex, is derived from an active marijuana ingredient and is used to treat various rare childhood-onset epilepsy disorders. The company primarily does business in Canada, Europe, the United States, and Asia. GW Pharmaceuticals has a market cap of $4.78 billion and does not pay a dividend yield. The stock has a price-to-book ratio of 9.36 and a very high price-to-sales ratio of 245.76. The company’s revenue has been falling each fiscal year since 2014, giving the company a negative 3-year revenue growth rate of -35.03% and a negative 5-year revenue growth rate of -24.29%.

Another option is Scotts Miracle-Gro, the largest provider of gardening and lawn care products in the United States. Headquartered in Ohio and founded in 1868, the company sells most of its products to retailers such as Home Depot, Lowe’s, and Walmart. Over recent years, the company has taken steps towards growing its hydroponics business, one of these actions being its acquisition of hydroponic equipment maker, Sunlight Supply Inc. Medical cannabis can be grown through hydroponics, so this transition has given Scotts Miracle-Gro its association with cannabis. Scotts Miracle-Gro has a market cap of $4.34 billion and has a yield of 2.82%. The stock trades at 17.96 times trailing earnings and at 17.48 times forward earnings. The stock has a price-to-book ratio of 8.34 and a normal price-to-sales ratio of 1.73. The company has a 3-year revenue growth rate of 0.82% and a negative 5-year revenue growth rate of -0.94%.

Tilray is a pharmaceutical company that researches, develops and sells medical cannabis. The company was founded in 2018 and is based in Canada. The company’s product portfolio includes dried cannabis as well as cannabis extract in the form of purified oil drops and capsules. Most of the Tilray’s revenue comes from its sales within Canada, but the company also sells its products in Argentina, Australia, Chile, Germany, South Africa, and many other countries. Tilray has a market cap of $11.99 billion and does not pay a dividend. The stock trades at 2500 times forward earnings. Its stock has a price-to-book ratio of 414.61 and a very high price-to-sales ratio of 374.42.

The cannabis industry should continue to grow as more and more states continue to legalize, and as more and more of the large blue-chip marijuana companies jump in.